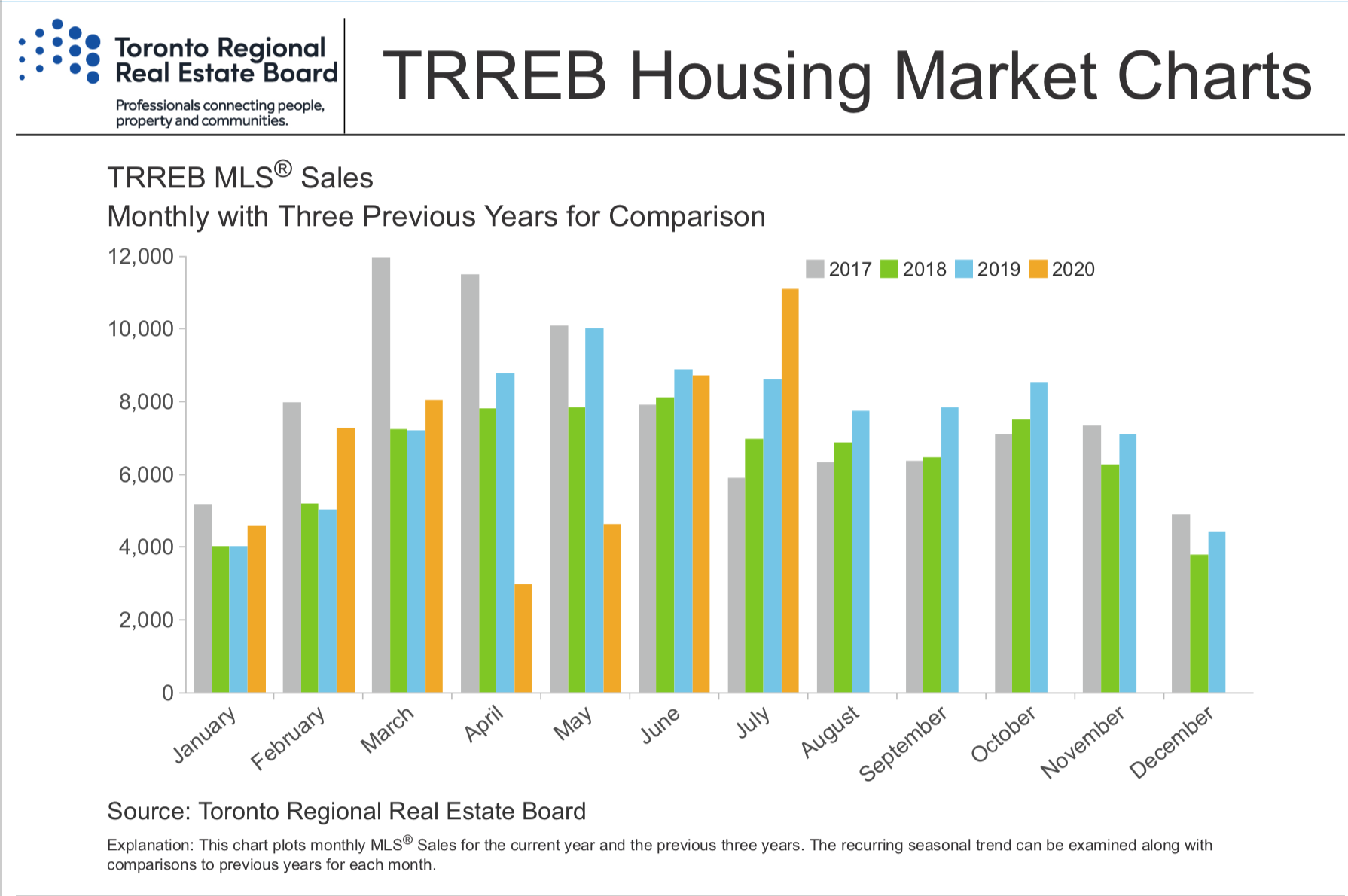

A record 121,712 sales were reported through TRREB’s MLS® System in 2021 – up 7.7 per cent from the previous 2016 high of 113,040 and up 28 per cent compared to 2020. Record demand last year was up against a constrained supply of listings, with new listings up by 6.2 per cent – a lesser annual rate than sales. The result was extremely tight market conditions and an all-time high average selling price of $1,095,475 – an increase of 17.8 per cent compared to the previous 2020 record of $929,636.

“Despite continuing waves of COVID-19, demand for ownership housing sustained a record pace in 2021. Growth in many sectors of the economy supported job creation, especially in positions supporting above-average earnings. Added to this was the fact that borrowing costs remained extremely low. These factors supported not only a continuation in demand for groundoriented homes, but also a resurgence in the condo segment as well,” said TRREB President Kevin Crigger.

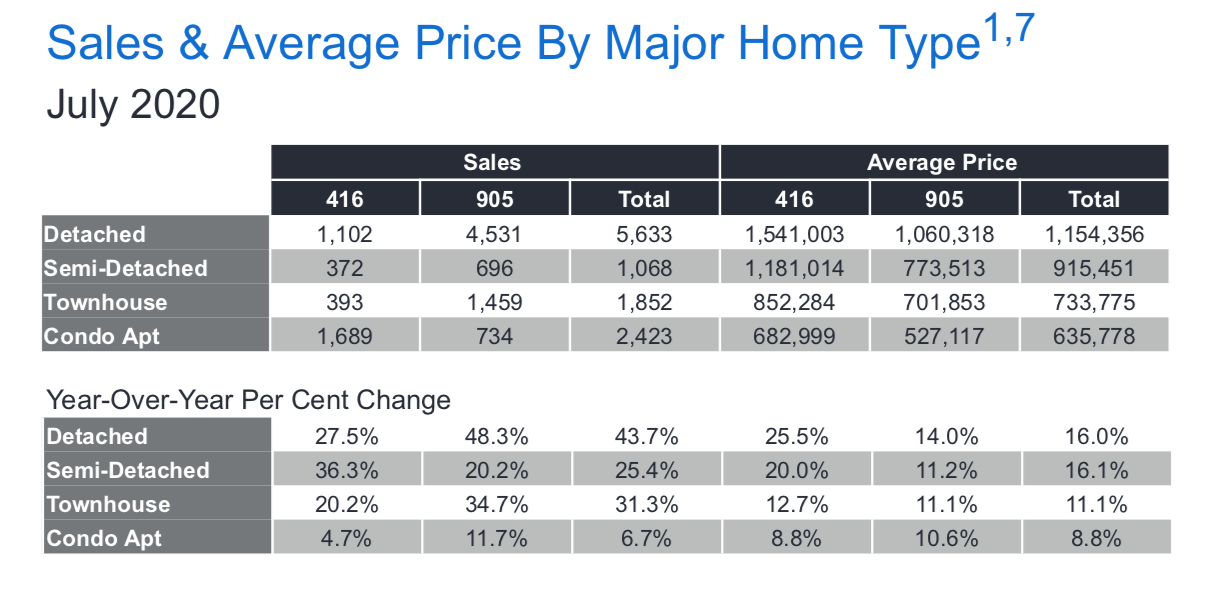

One sales trend that stood out in 2021 compared to 2020 was the resurgence in demand for homes within the City of Toronto. Overall sales in the “416” area code were up by a substantially greater annual rate (+36.8 per cent) compared to sales growth for the surrounding Greater Toronto Area (GTA) suburbs combined (+23.6 per cent). The marked recovery in the condominium apartment segment was a key driver of this trend.

“Tight market conditions prevailed throughout the GTA and broader Greater Golden Horseshoe in 2021, with a lack of inventory noted across all home types. The result was intense competition between buyers, pushing selling prices up by double digits year-over-year. Looking forward, the only sustainable way to moderate price growth will be to bring on more supply. History has shown that demand-side policies, such as additional taxation on principal residences, foreign buyers, and small-scale investors, have not been sustainable long-term solutions to housing affordability or supply constraints,” said TRREB Chief Market Analyst Jason Mercer.

In December, GTA REALTORS® reported 6,031 sales – a strong result historically, but still down by more than 1,000 transactions (-15.7 per cent) compared to the record of 7,154 set in December 2020. Over the same period, new listings were down by 11.9 per cent to 5,174. The MLS® Home Price Index Composite benchmark was up by 31.1 per cent yearover-year in December. The average selling price was up by 24.2 per cent annually to $1,157,849.

If you would like to find out what these statistics mean to you, or if you are curious to know how much your property is worth today or how much you can afford to buy, please reach out.

If you found this article helpful please hit "Like" and "Share".

#torontoliving #toronto #thejunction #highpark #bloorwestvillage #homesellers #homebuyers #realestatebroker #lubabeleybroker #sellingrealestate #sellingtorontohomes #serviceyoucantrust #workingforyou #lubabeleyrealestateservices #royallepagebroker #decemebermarketstats