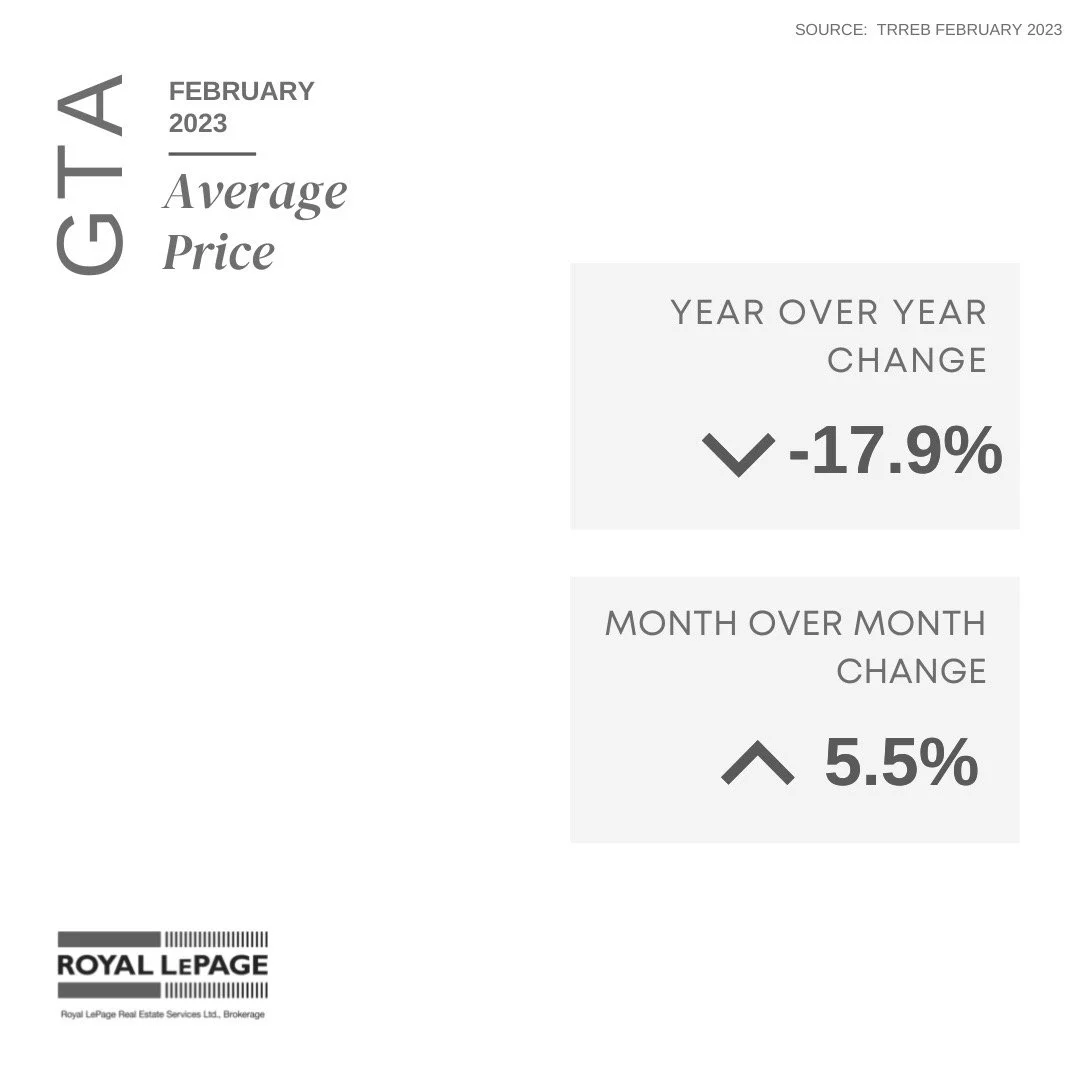

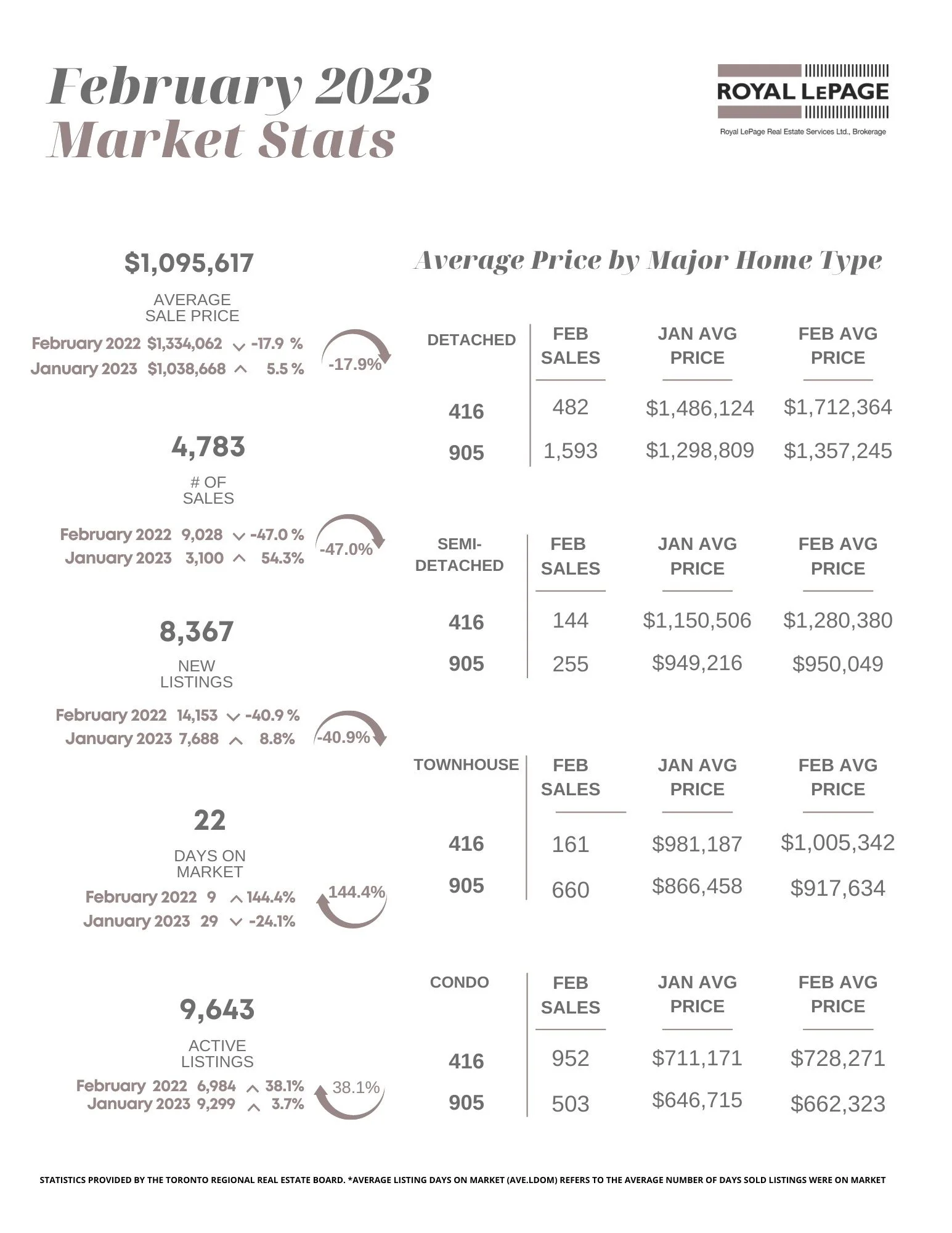

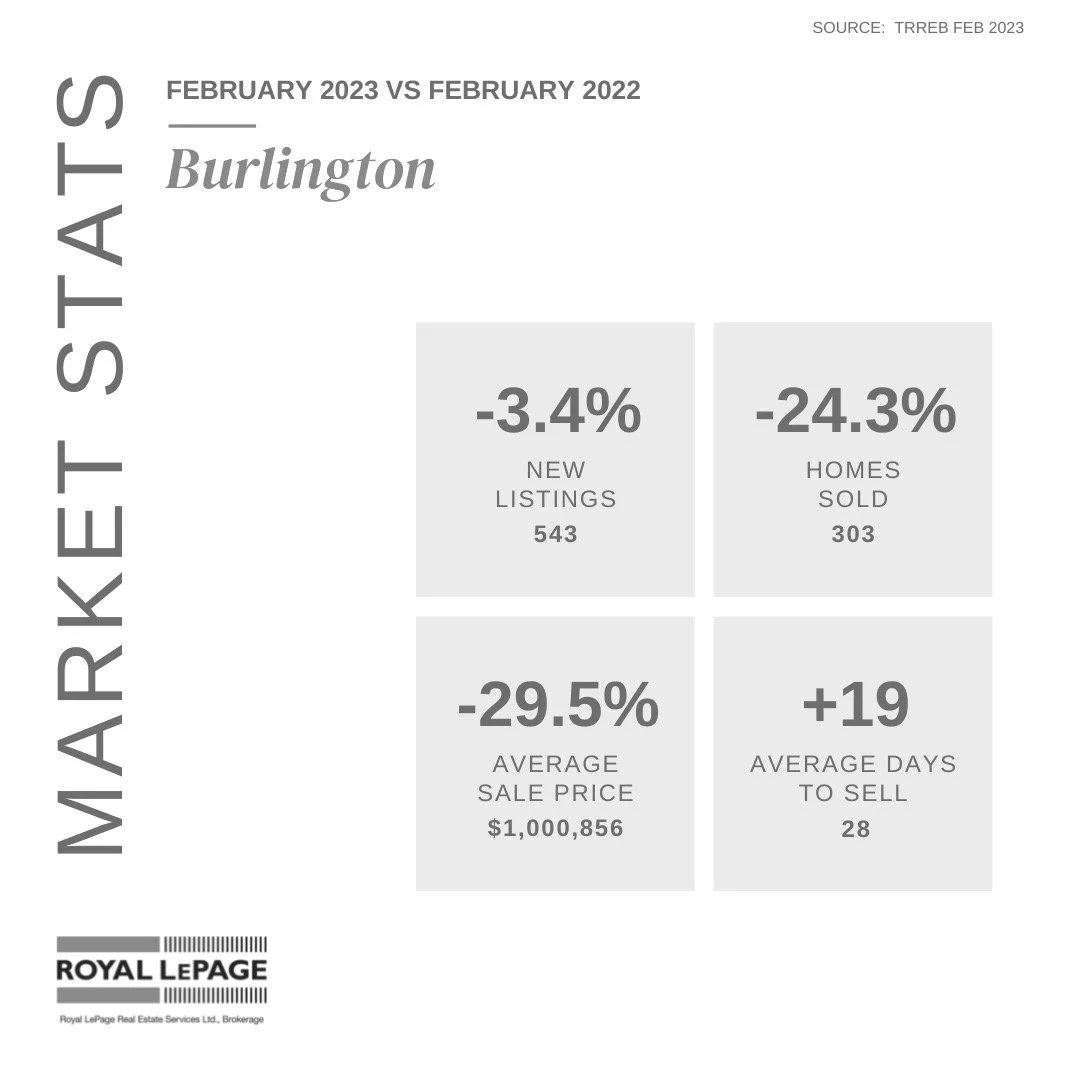

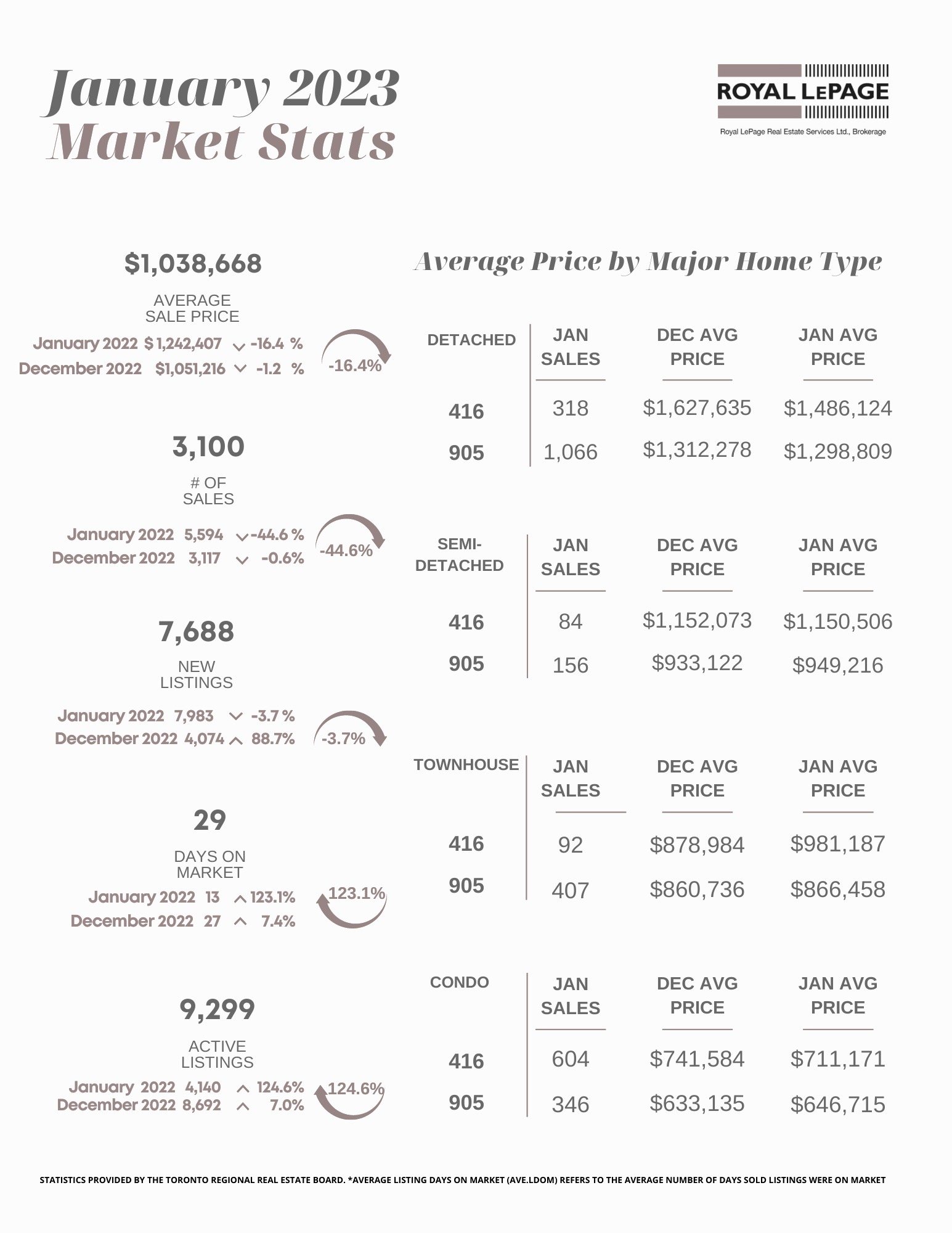

In May, the housing market in the Greater Toronto Area (GTA) continued its upward trajectory, displaying an impressive rally in home prices. The average price surged by $42,832, marking the second consecutive month of substantial gains exceeding $40,000. This surge is particularly noteworthy when compared to the market bottom observed in January, where properties were selling at an average of $1,038,668. Since then, home values have experienced a commendable recovery, reclaiming $157,433 of the previously incurred losses.

The resilience of the GTA housing market is undeniably apparent, with an extraordinary rebound that has recouped 53% of the losses incurred during an 11-month period marked by eight consecutive interest rate increases. Remarkably, this substantial recovery has materialized in just four months, reflecting the market's exceptional resilience and adaptability.

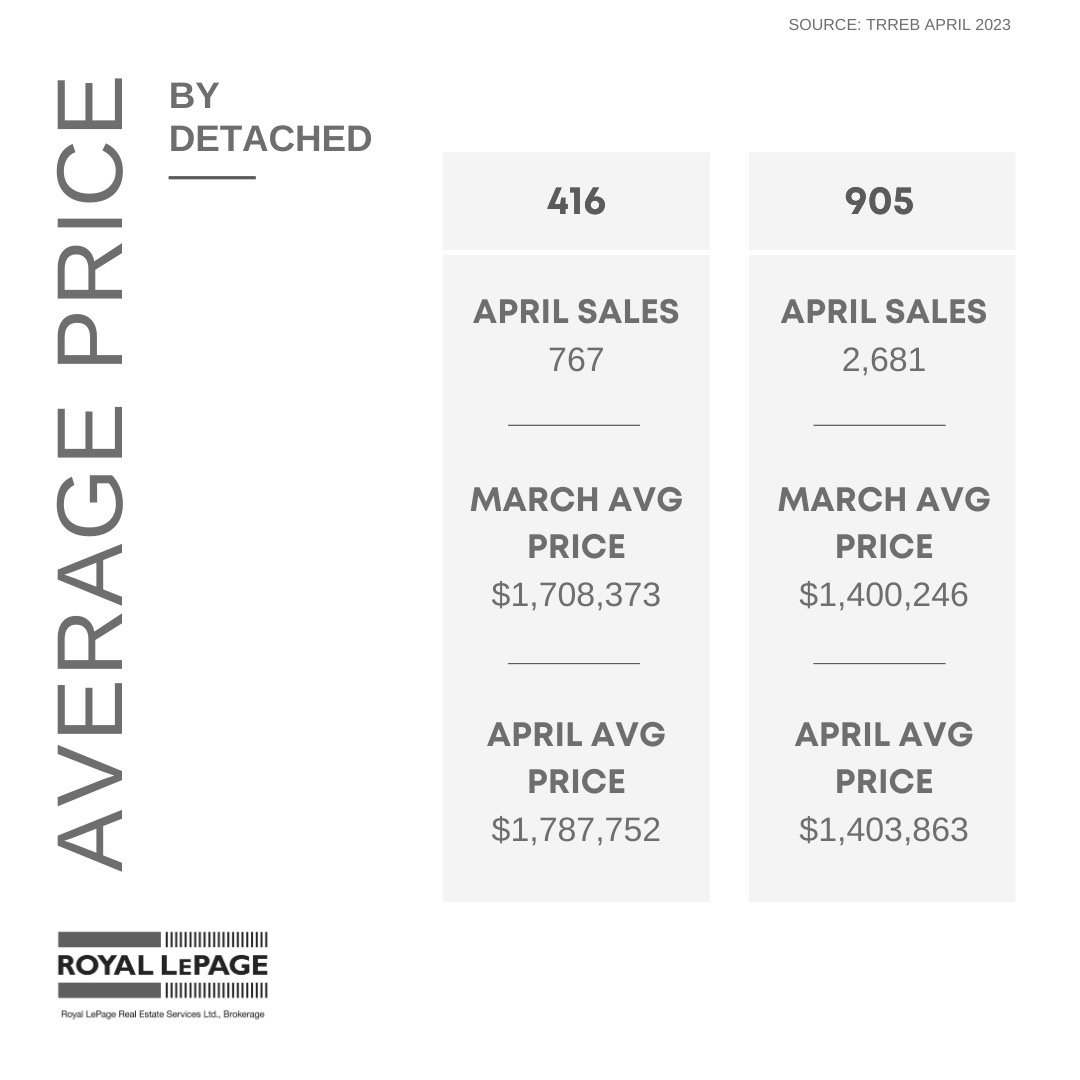

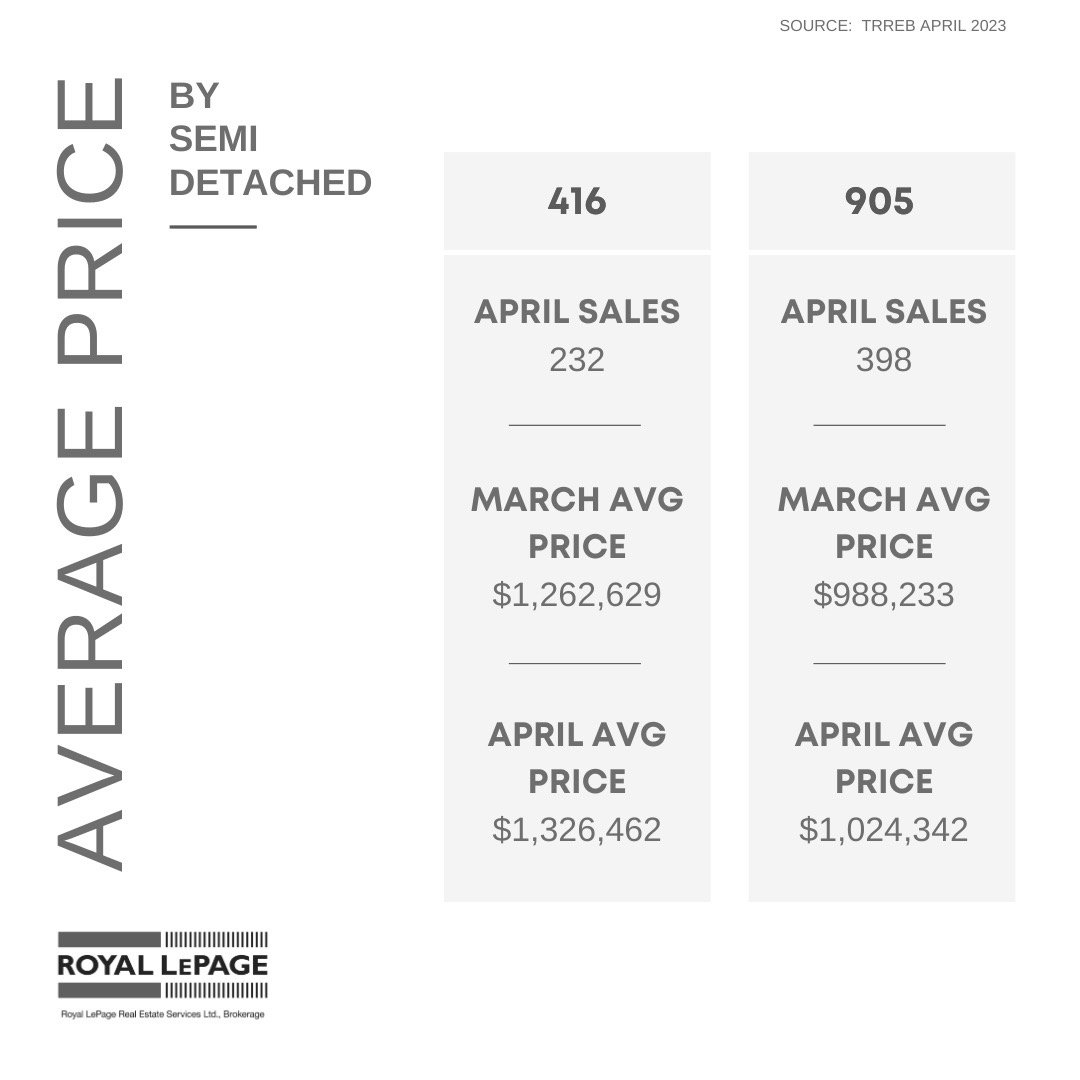

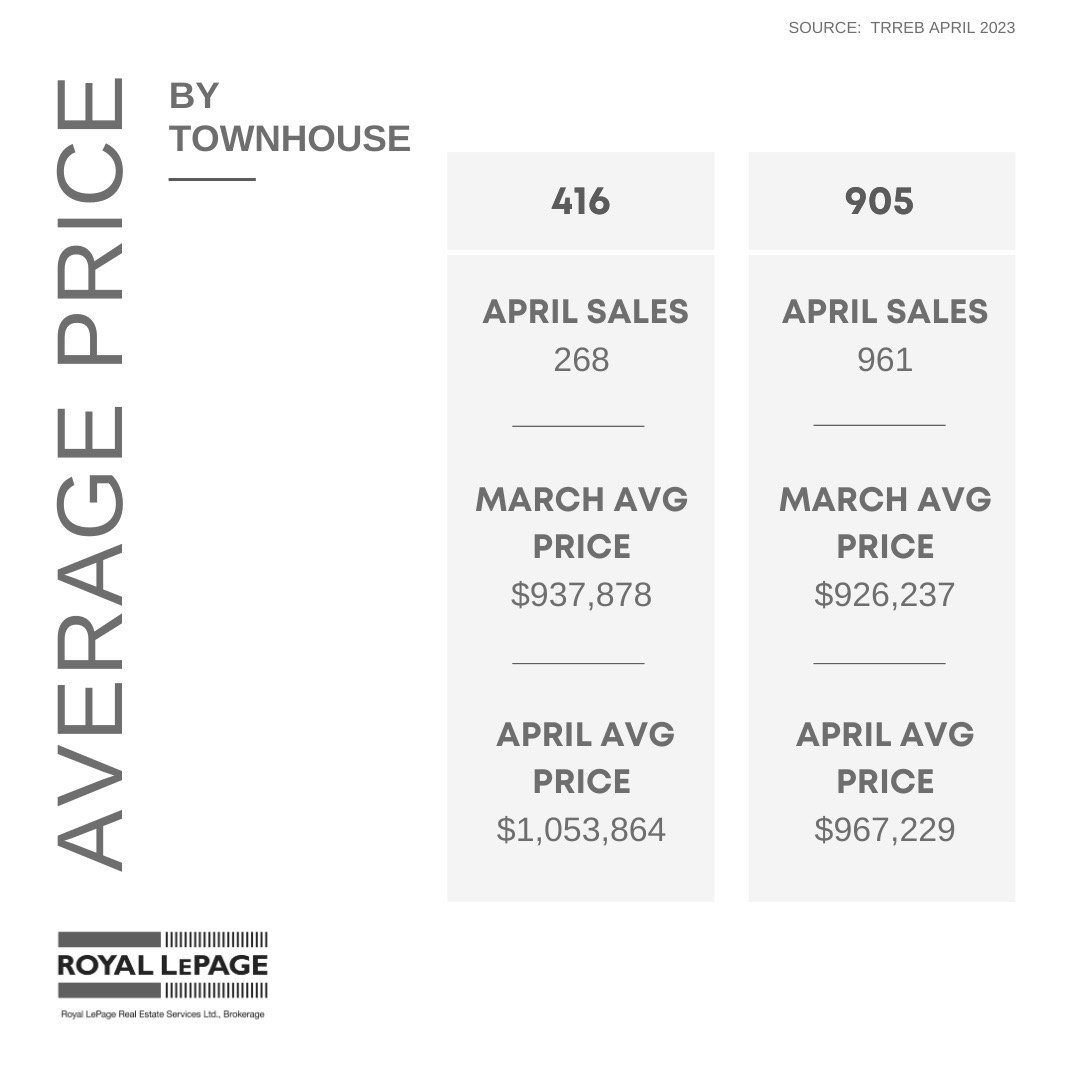

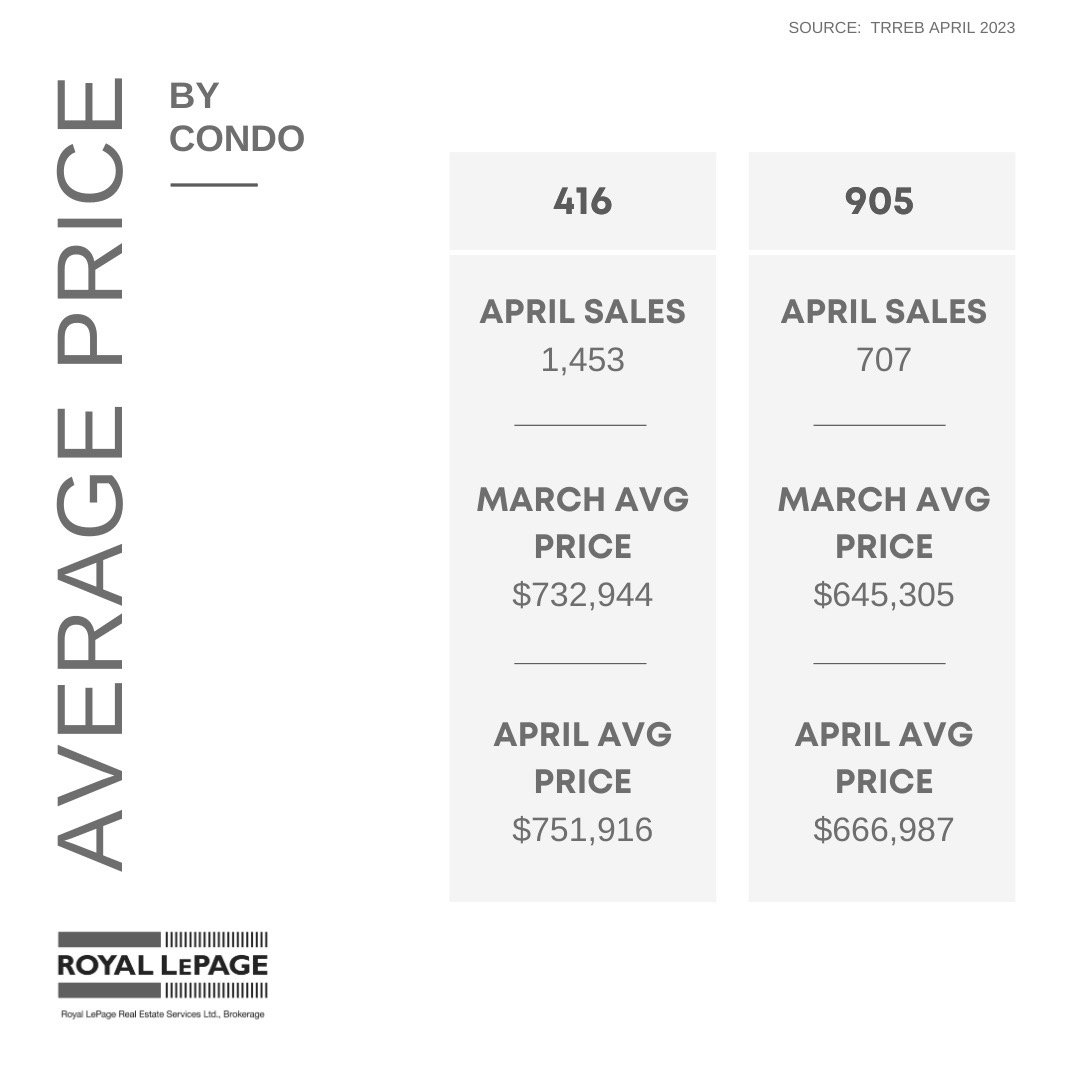

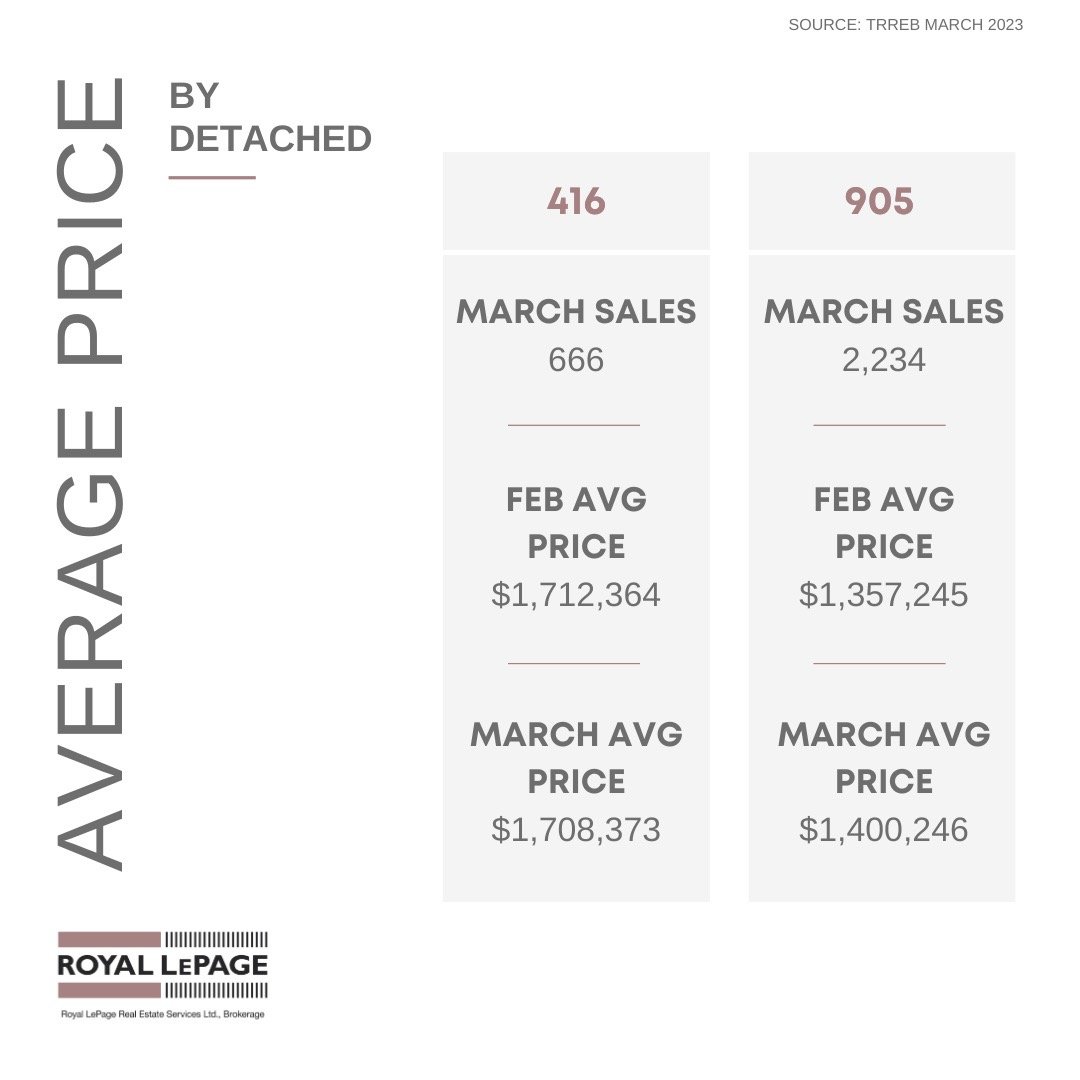

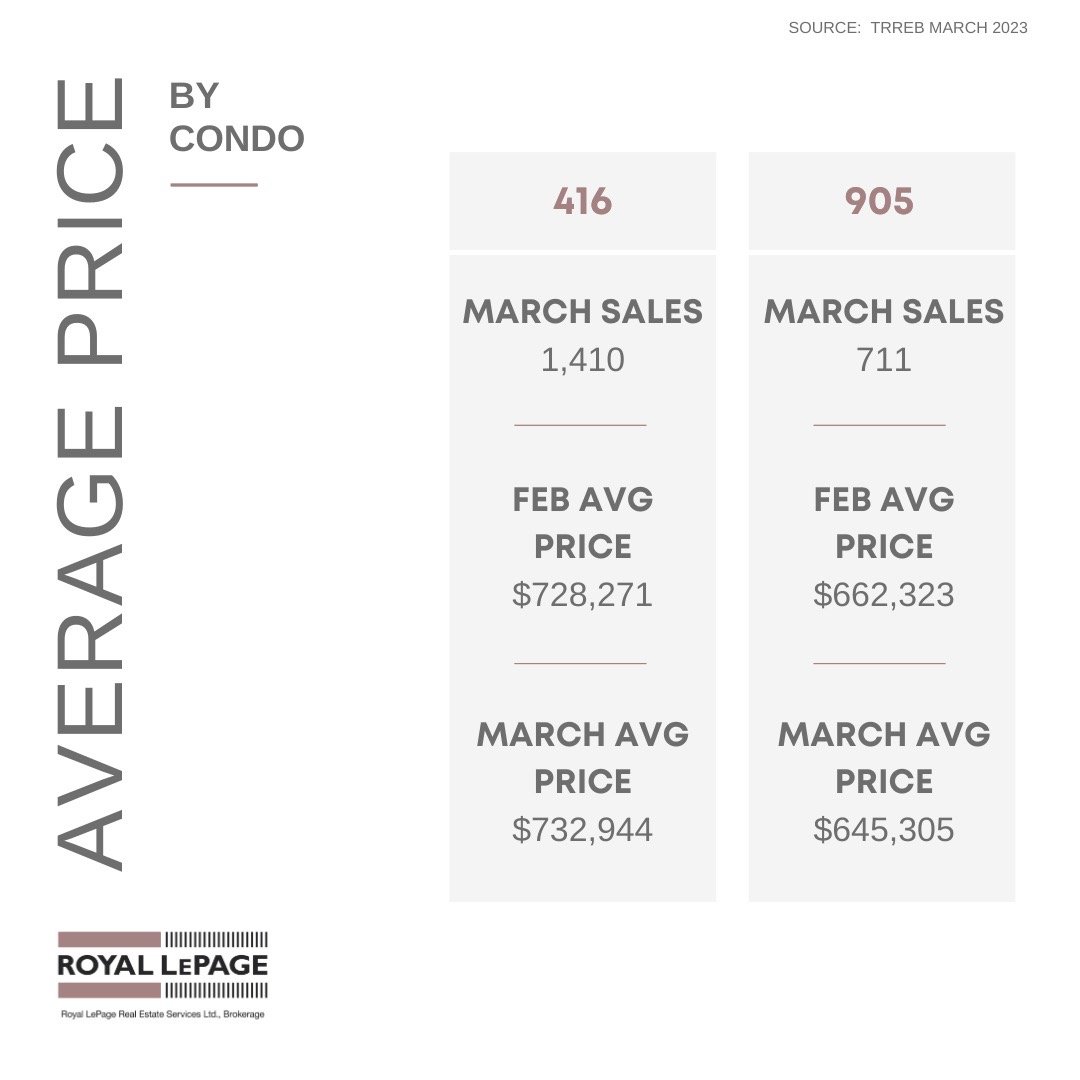

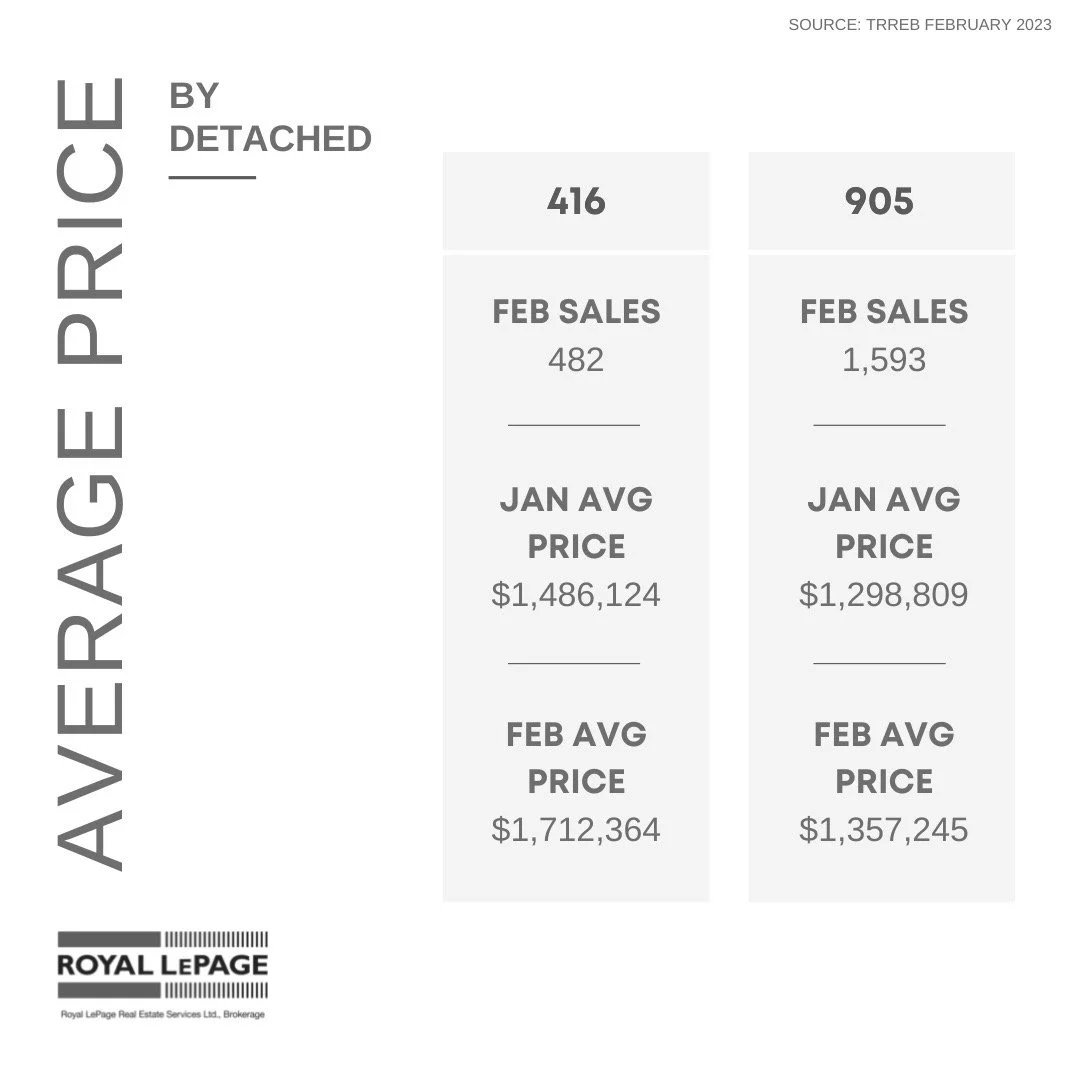

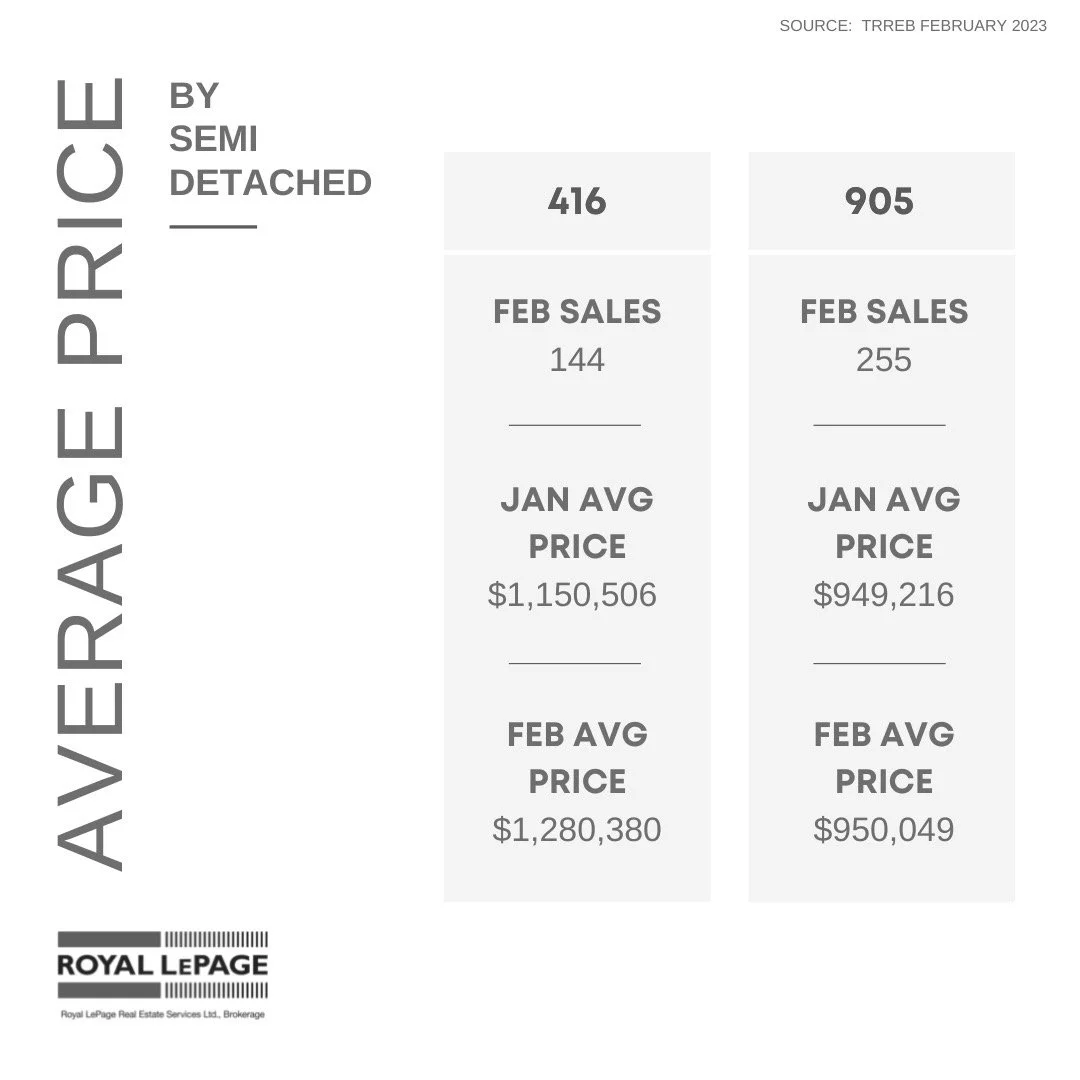

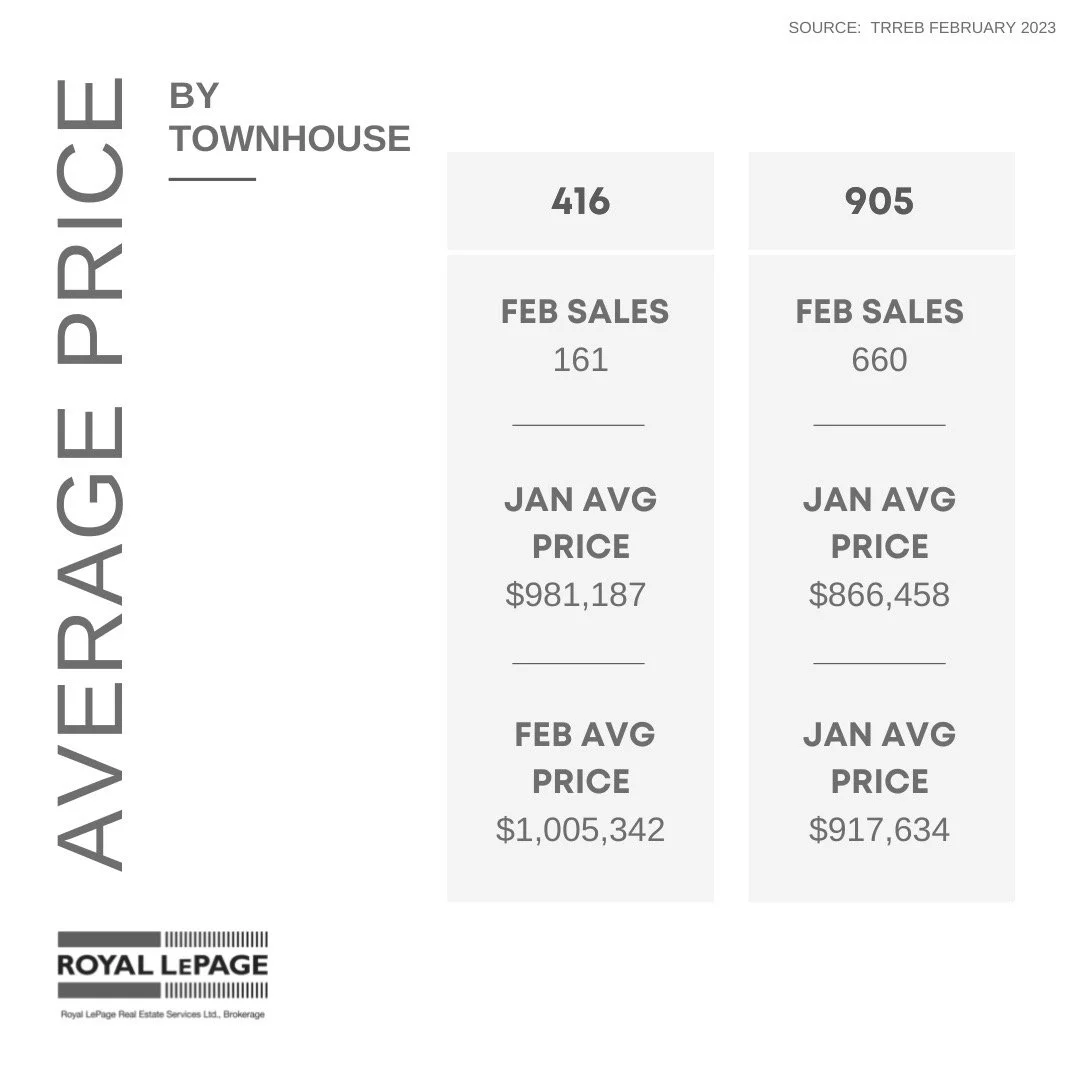

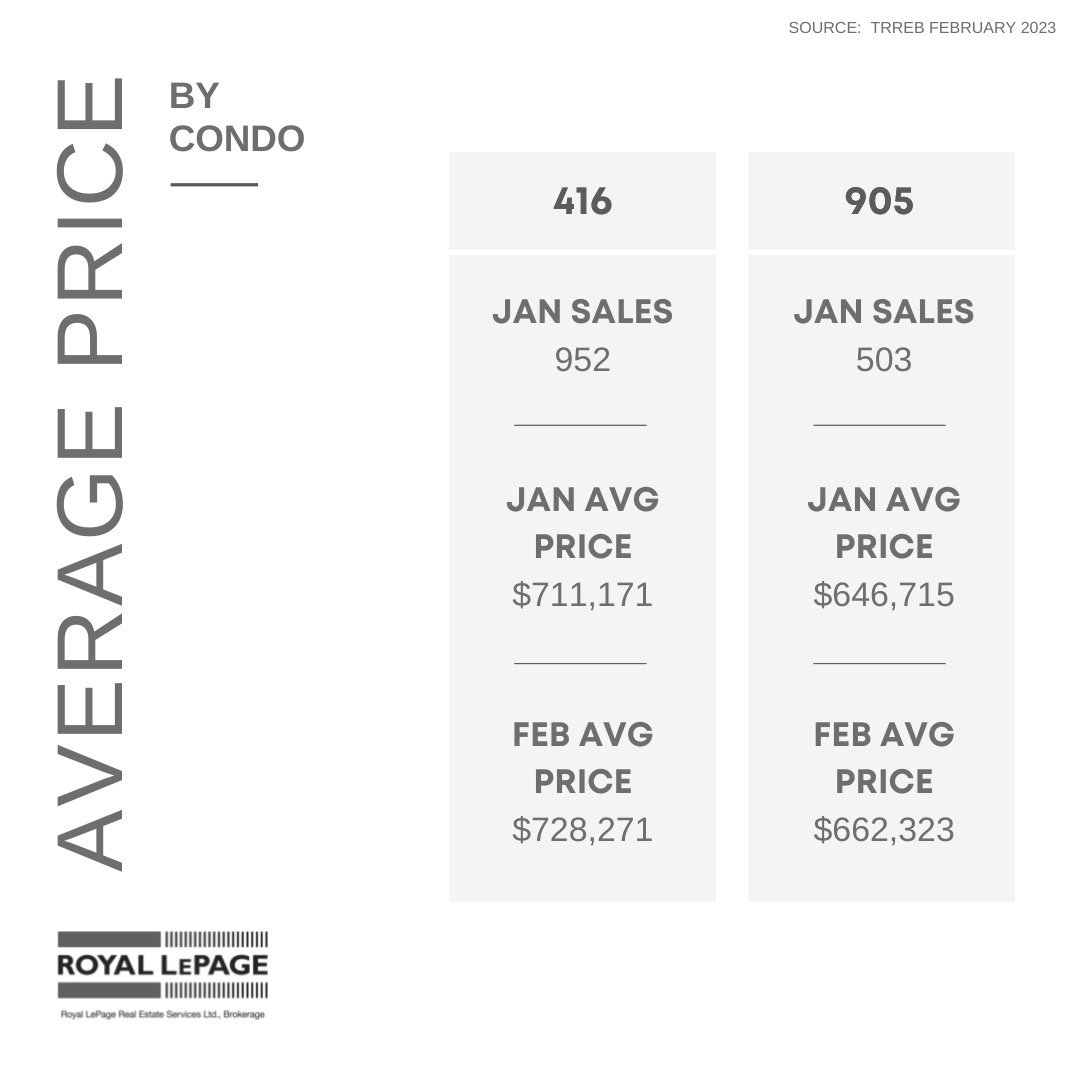

The recovery rally in 2023 has been widespread, with all major asset classes across the GTA participating. Leading the recovery march is the Semi-Detached segment, which has recouped over $188,000 or 54% since the market bottom, bringing the average sales price in May to $1,198,185. The Townhouse and Condo markets have also made significant strides, recovering over 50% of their losses, with price increases of $163,384 and $60,787, respectively. Consequently, the average sales prices for Townhouses and Condos during May stood at $1,117,696 and $748,483. The Detached market, although lagging in comparison, has still achieved an impressive recovery of 47%, amounting to $214,718, resulting in an average sales price of $1,556,566. This rapid recovery and market strength have sparked anticipation among investors, as highlighted in the 2023 Royal LePage Investors Report.

In the Royal LePage survey conducted by Leger, 23% of Canadians who do not own a residential investment property say that they are likely to purchase one in the next five years, and more than half (51%) of current investors say that they are likely to purchase an additional residential investment property within the same time period. Overall, 26% of all Canadians, current investors or otherwise, plan to buy an investment property before 2028.

“We know that the value of home ownership is strong among Canadians – it is clear that possessing real estate remains a desirable means for building wealth over time. Many choose to invest in real estate not only as a way of generating income and reaping the benefits of value appreciation, but to provide an opening into the market for future generations of their family, ” said Phil Soper, president and CEO, Royal LePage. “Despite the hurdles of low home supply and increased lending rates, young people are more inclined than ever to make real estate investing a part of their financial planning for the future. In fact, survey results tell us that many of them are actually prioritizing an investment property over owning their primary residence.”

The persistently low inventory levels continue to exert upward pressure on sale prices, resulting from historically low levels of homes for sale across the overall market. In May, there were only 11,868 active properties, representing a 31% decrease compared to the average of the preceding 10 years.

Despite the limited inventory, sales have shown improvement across all segments. In May, there were 9,012 sales, a rise of 1,418 compared to the previous month. Considering the 31% decrease in inventory levels compared to historical norms, one might expect a similar decline in sales. However, the data presents a contrary picture, with sales only down 8% from historical levels. Notably, the Condo market led the way in May, with 2,568 sales, representing an increase of 408 from the previous month and more than a 10% rise compared to the average of the preceding 10 years. The Detached market experienced the largest monthly increase, with 4,049 sales, surpassing April's figures by over 601 properties but is still down 15% from historical levels. Both the Semi-Detached and Townhouse markets also demonstrated solid growth, with 787 and 824 sales, respectively, reflecting increases of 157 and 183 compared to the previous month.

“The demand for ownership housing has picked up markedly in recent months. Many homebuyers have recalibrated their housing needs in the face of higher borrowing costs and are moving back into the market. In addition, strong rent growth and record population growth on the back of immigration has also supported increased home sales. The supply of listings hasn't kept up with sales, so we have seen upward pressure on selling prices during the spring,” said TRREB Chief Market Analyst Jason Mercer.

Overall, May was another favourable month for sellers, characterized by increasing home sale prices and escalating competition, resulting in properties selling for 105% of the asking price—the highest level since April 2022. While sellers rejoice as the market rallies, potential buyers may have concerns. Negative headlines emerged in May, such as the increase in April's inflation rate to 4.4%. If inflation persists, the Bank of Canada could be compelled to implement another interest rate hike, which may moderate the rapid pace of property value increases. However, it is unlikely that move would address the core issue of limited inventory, which remains the primary factor behind price increases.

MAY 2023 MARKET STATS SUMMARY

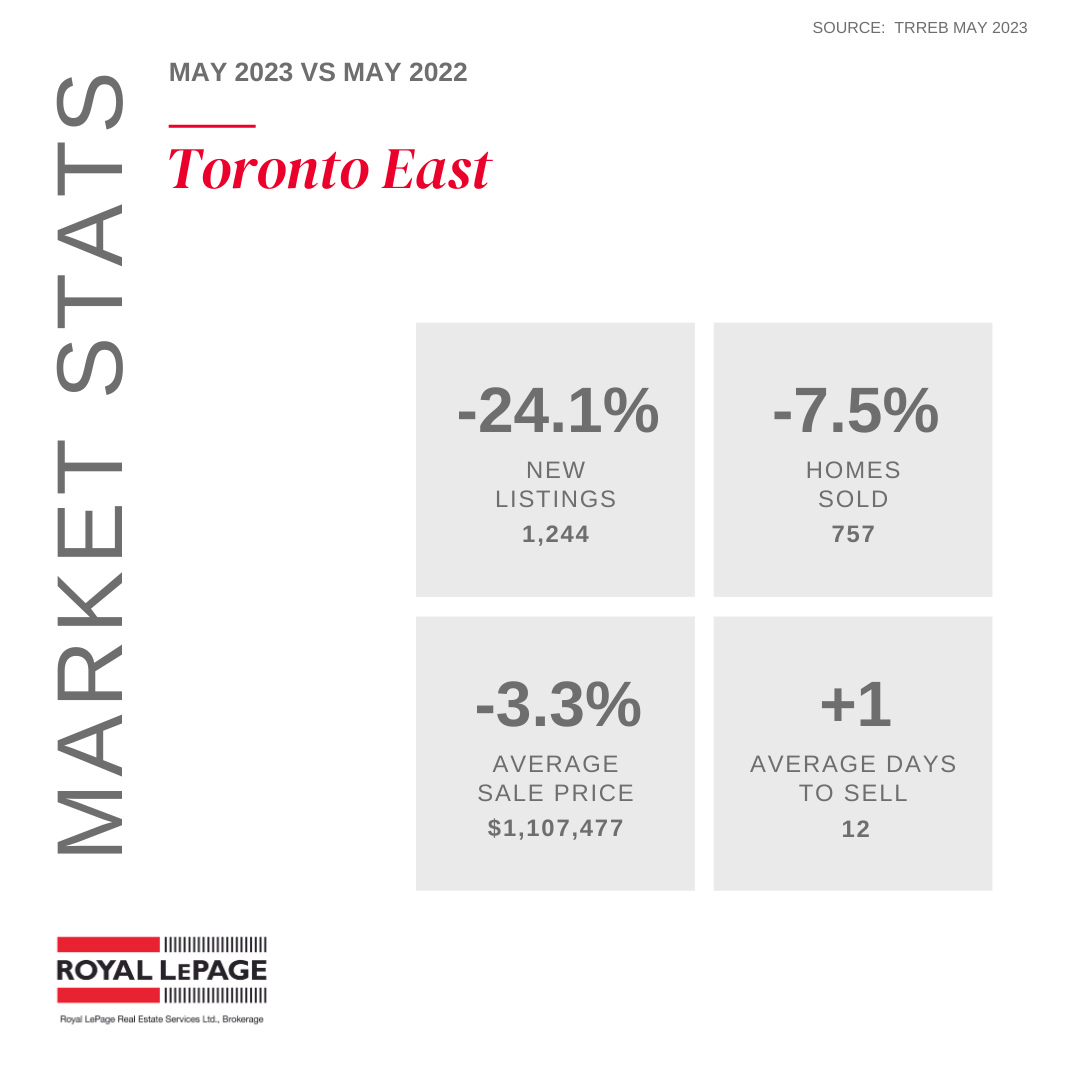

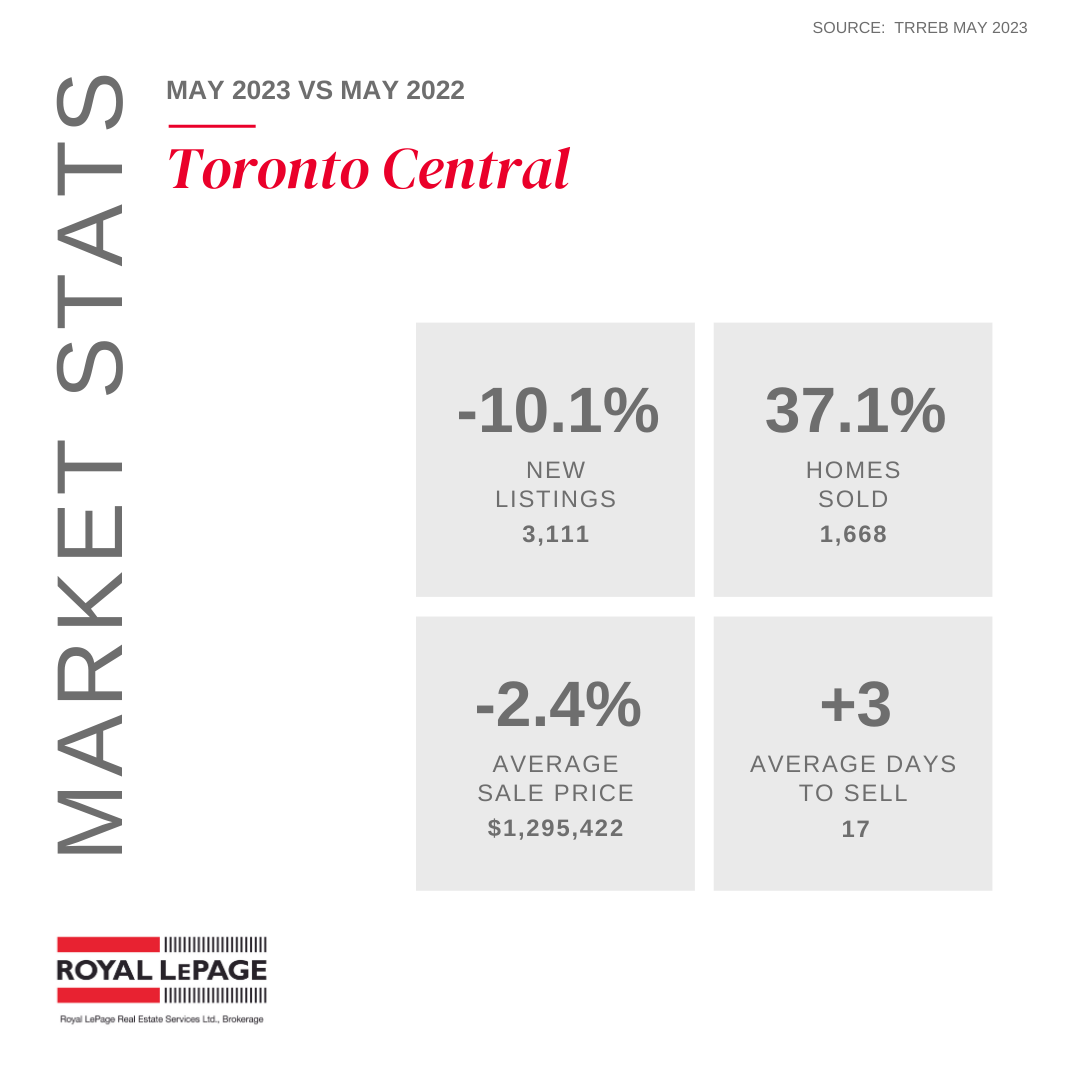

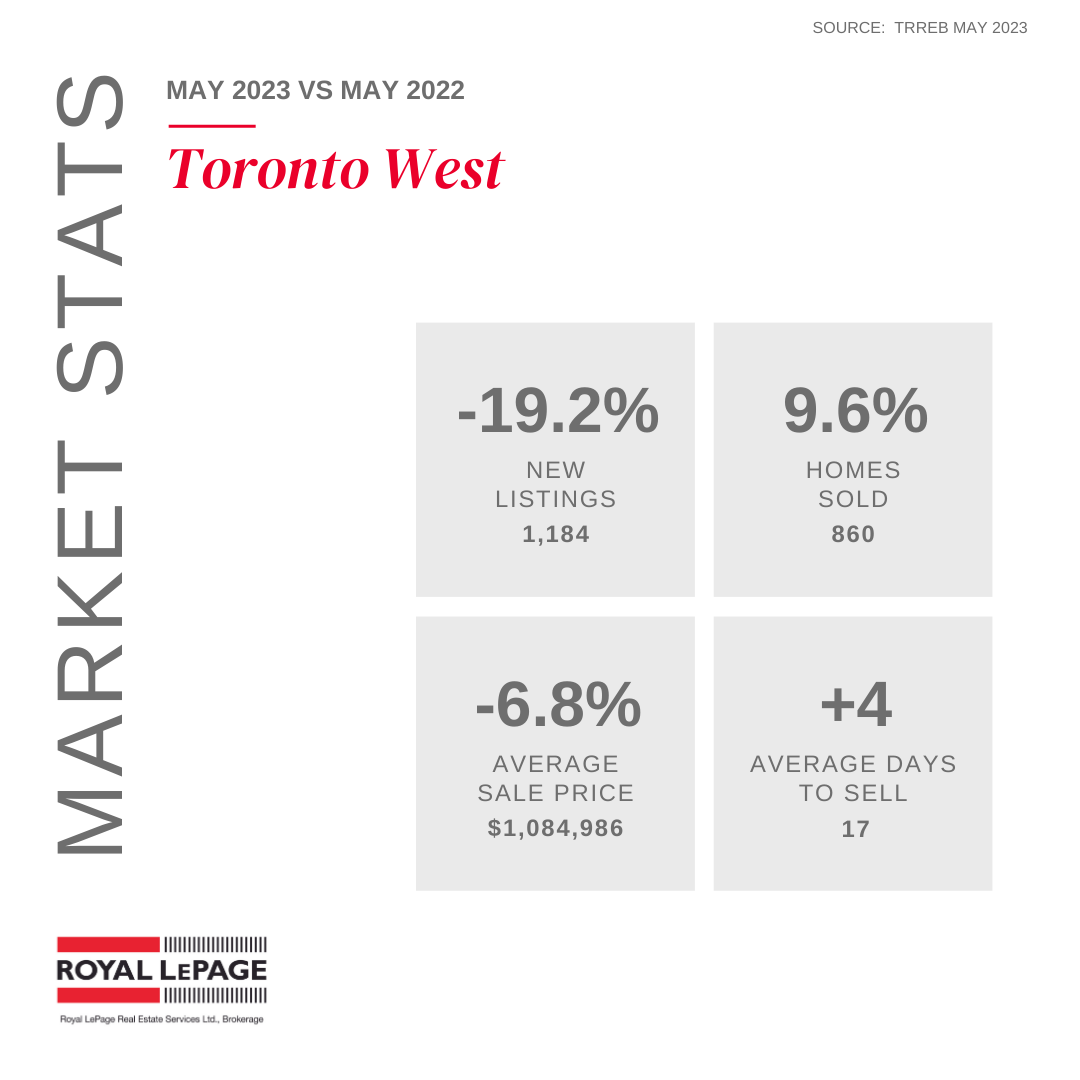

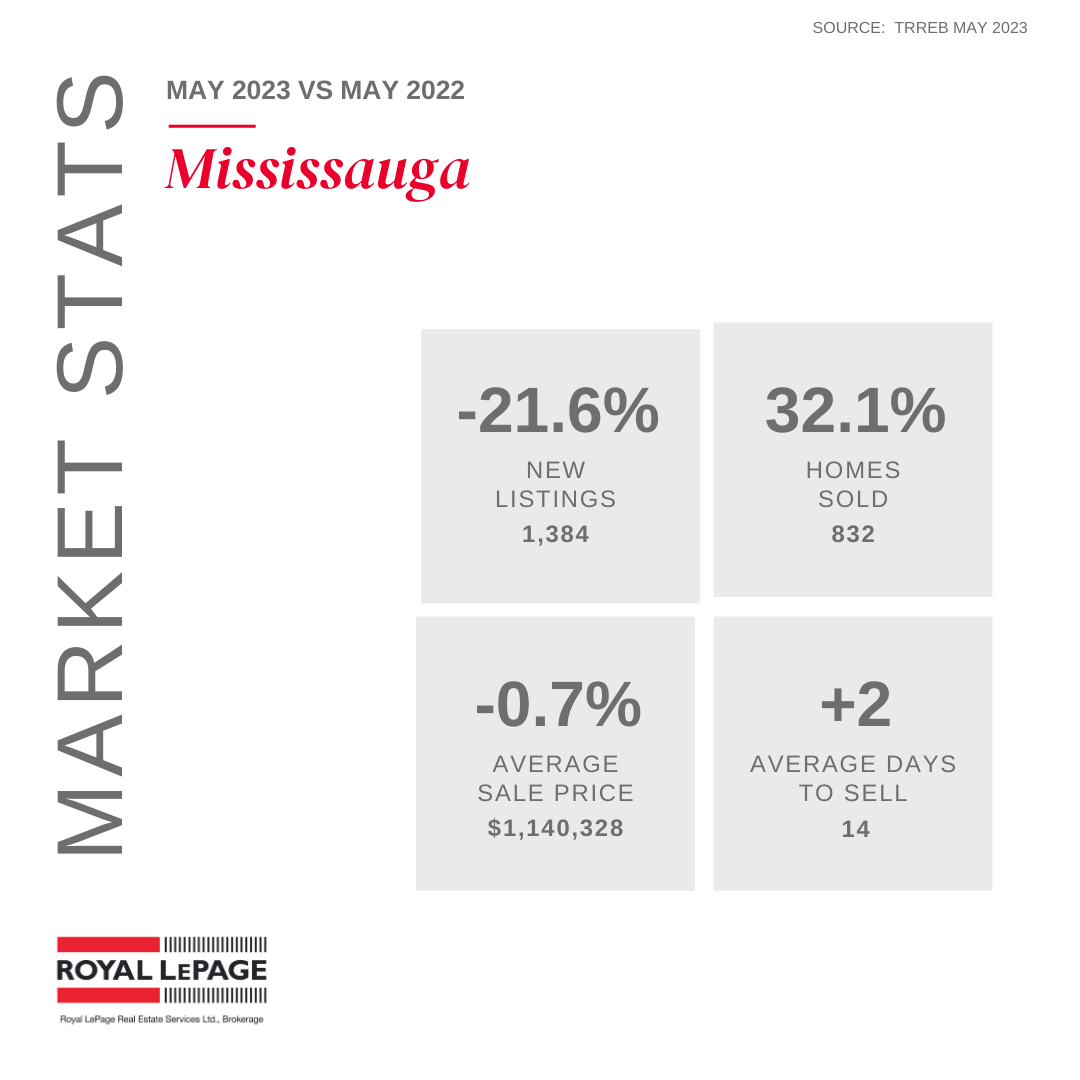

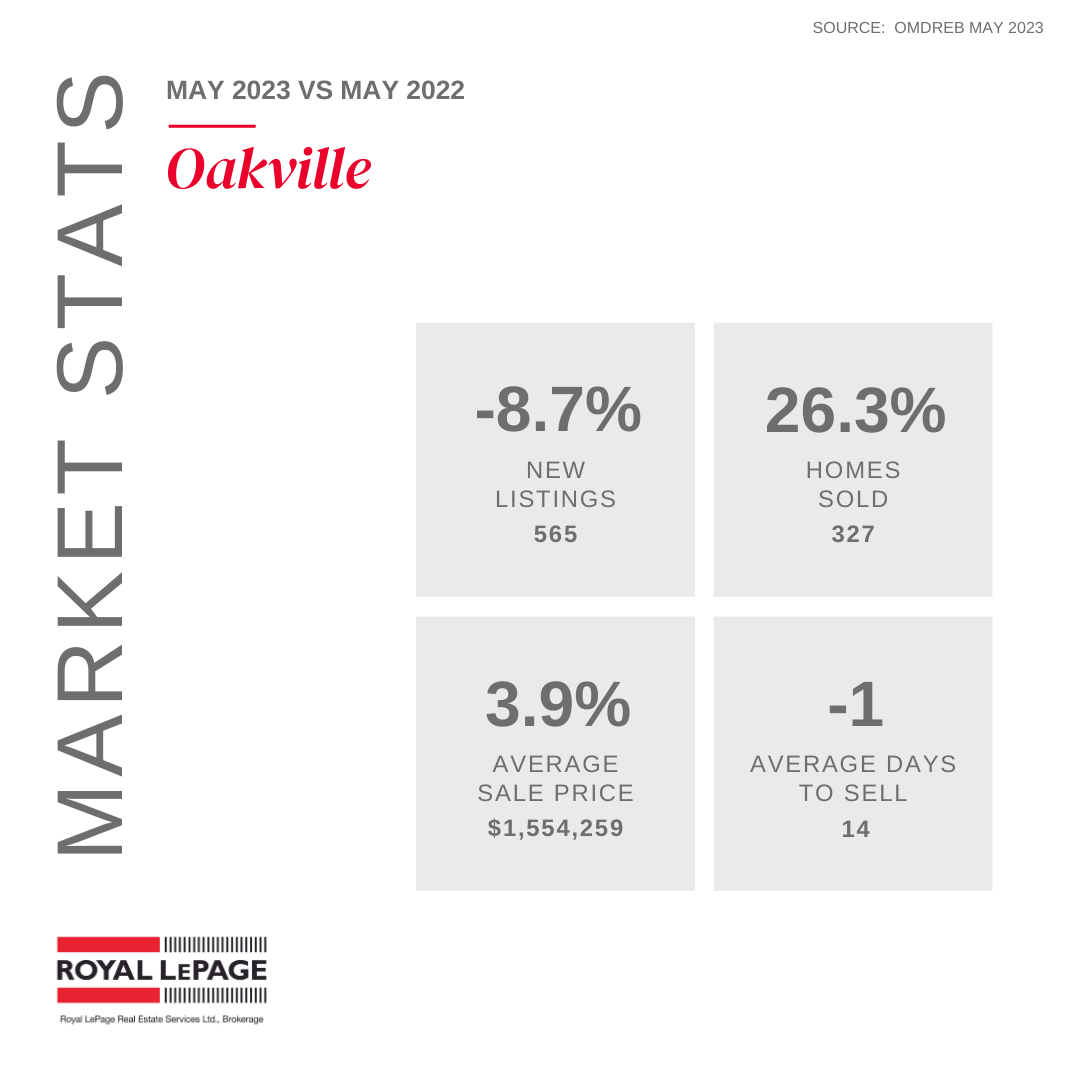

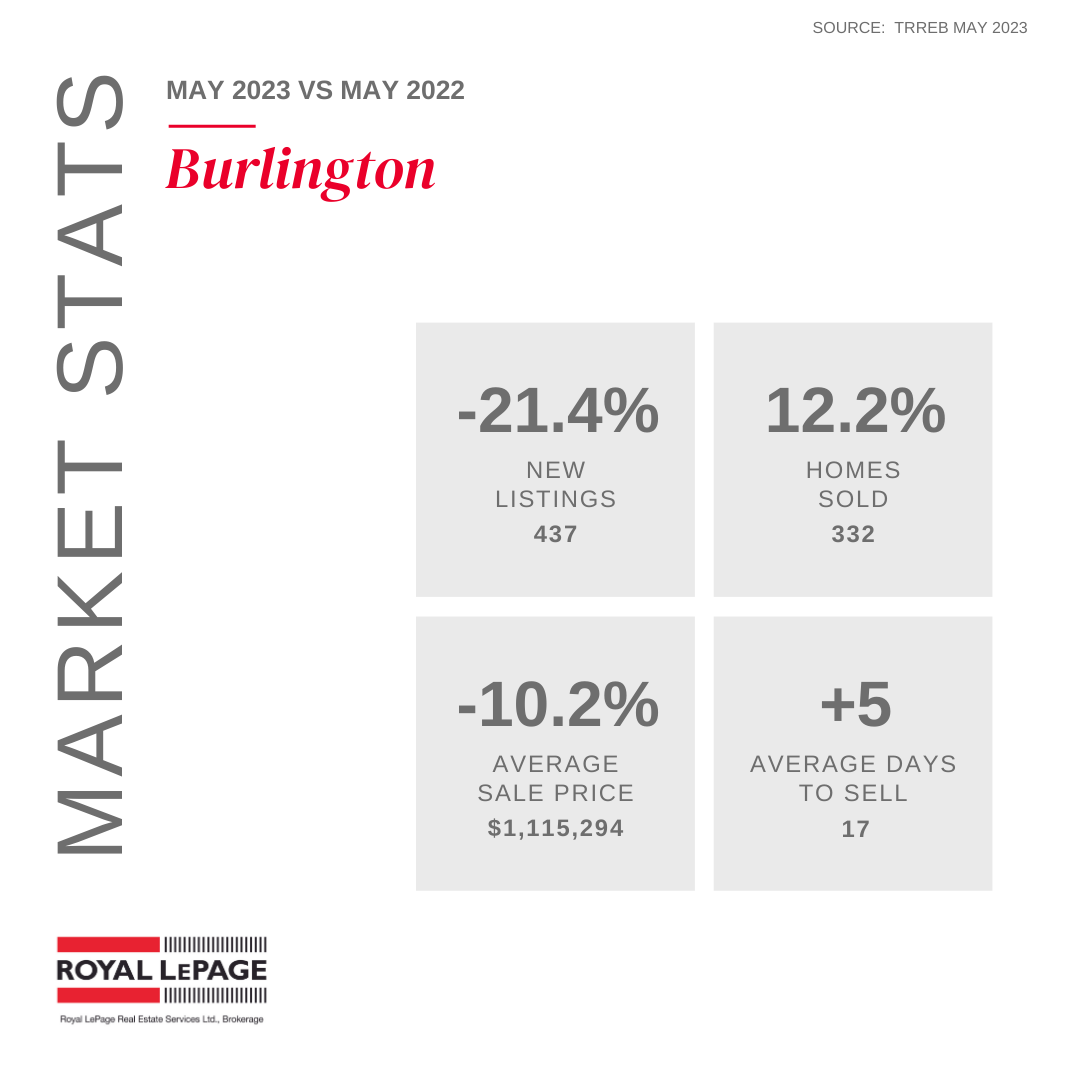

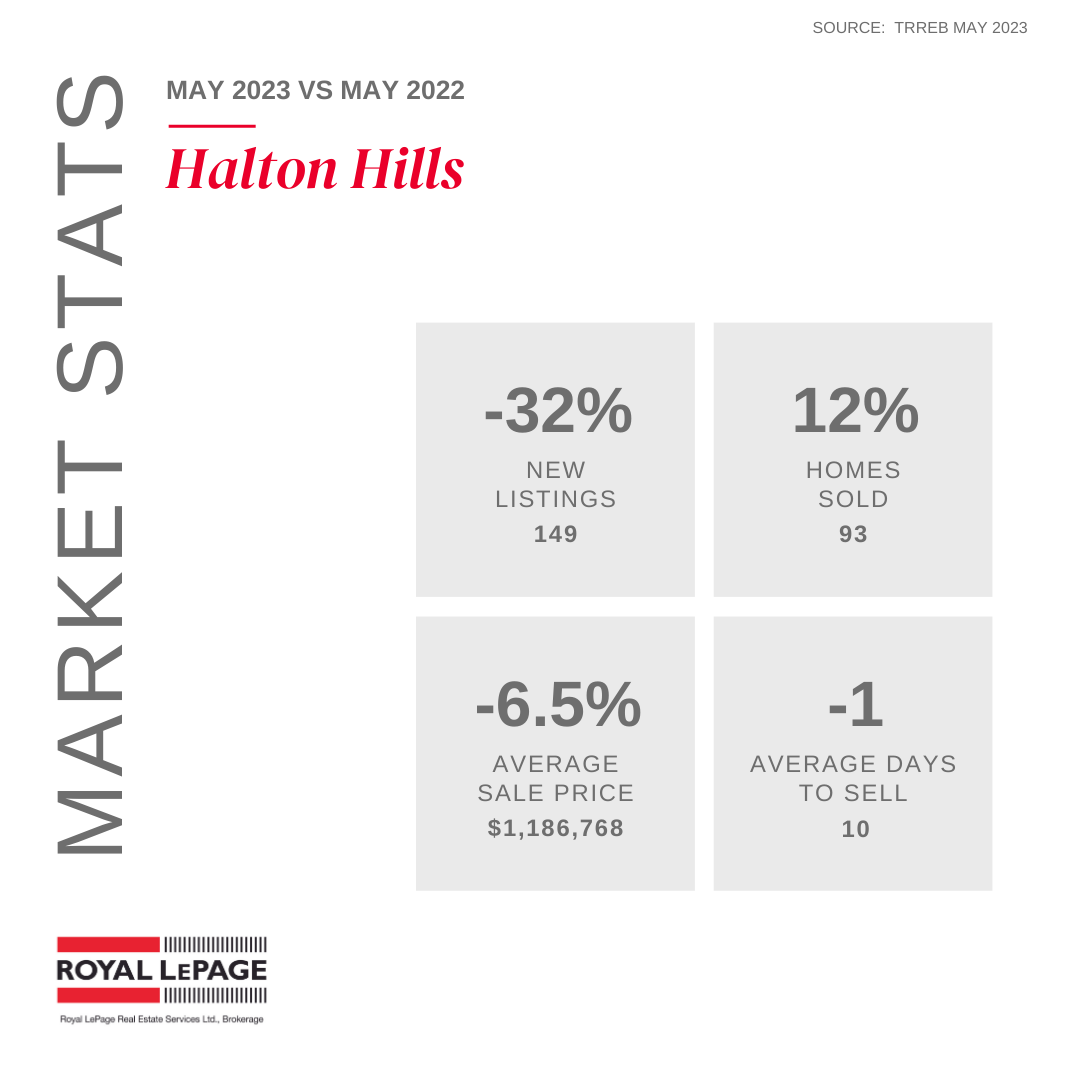

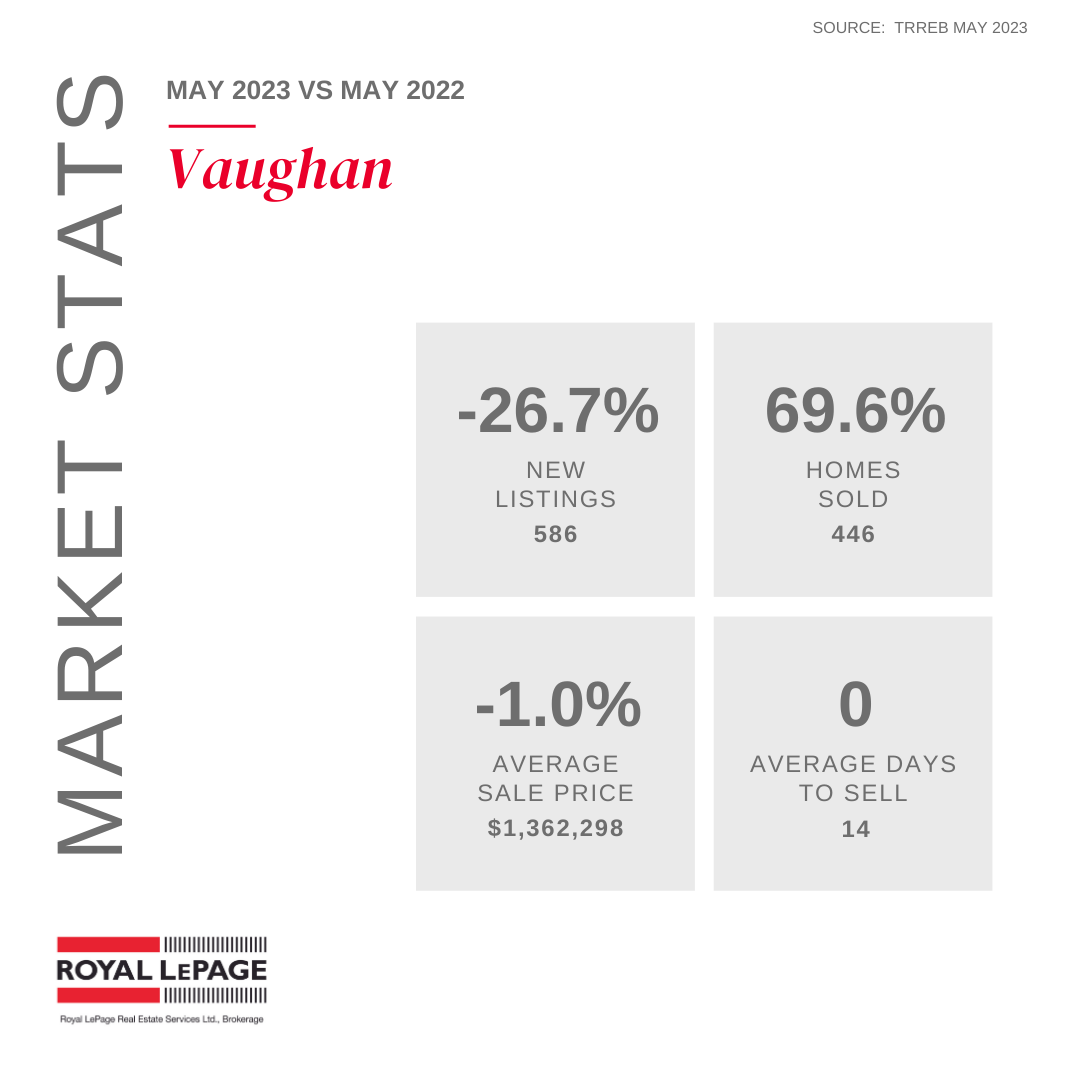

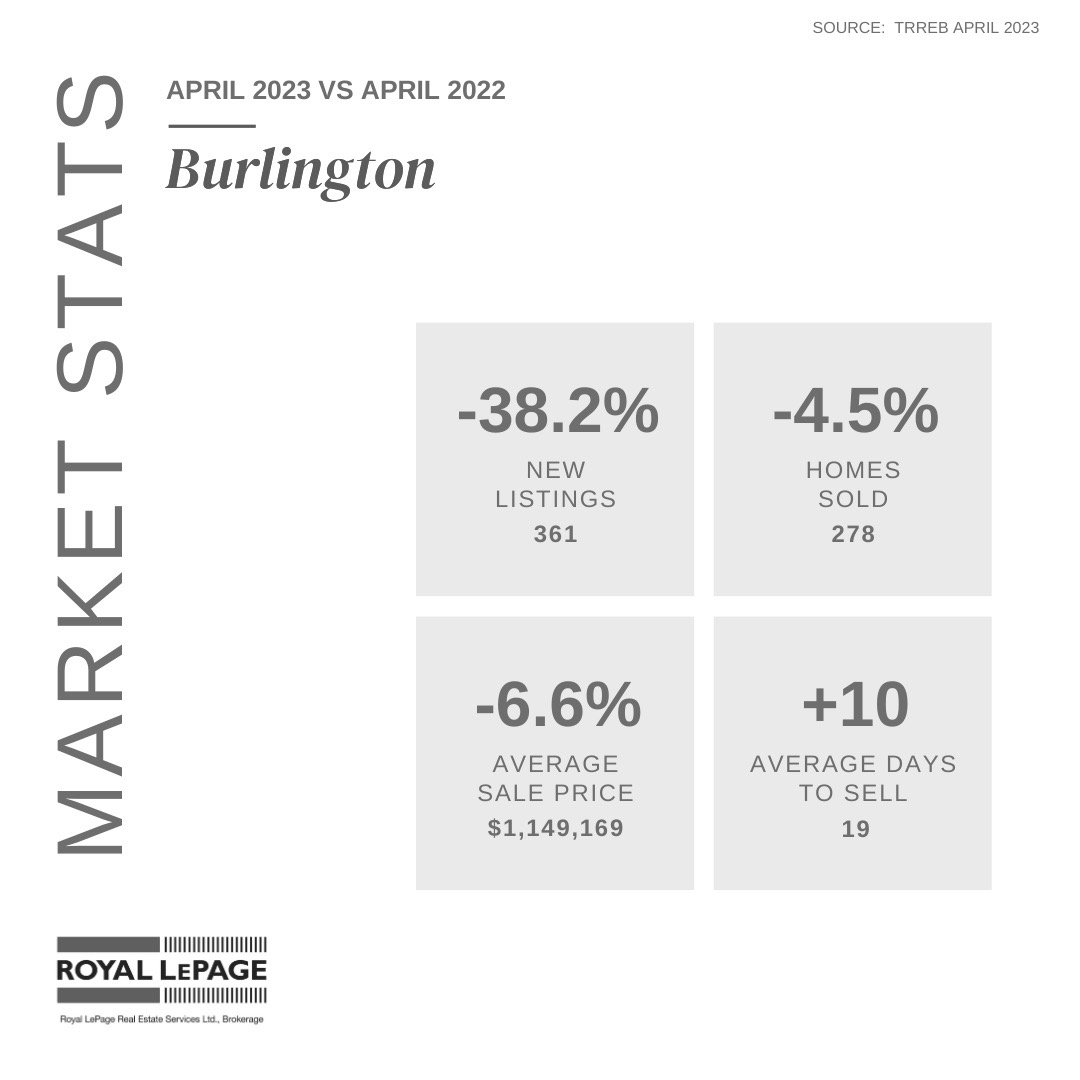

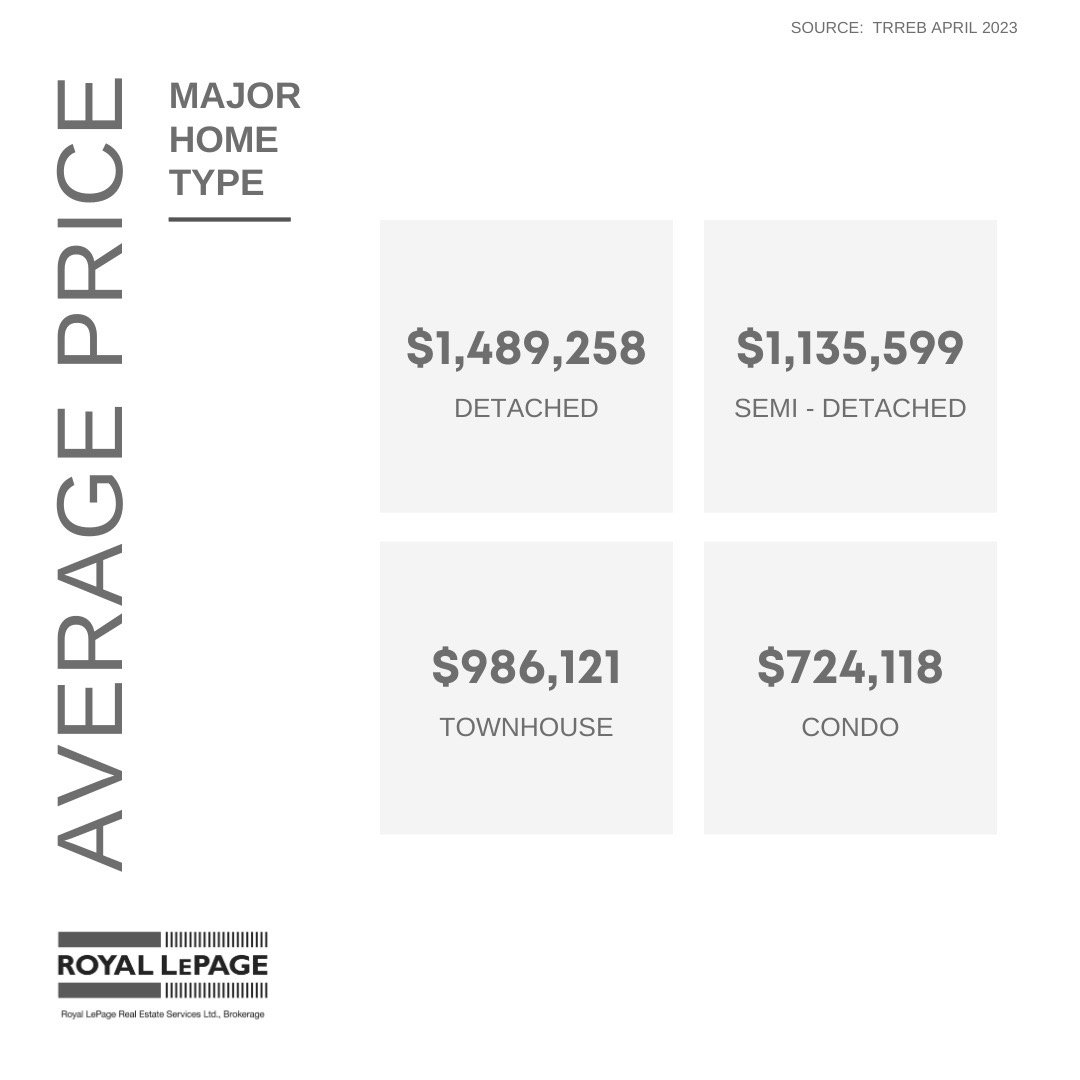

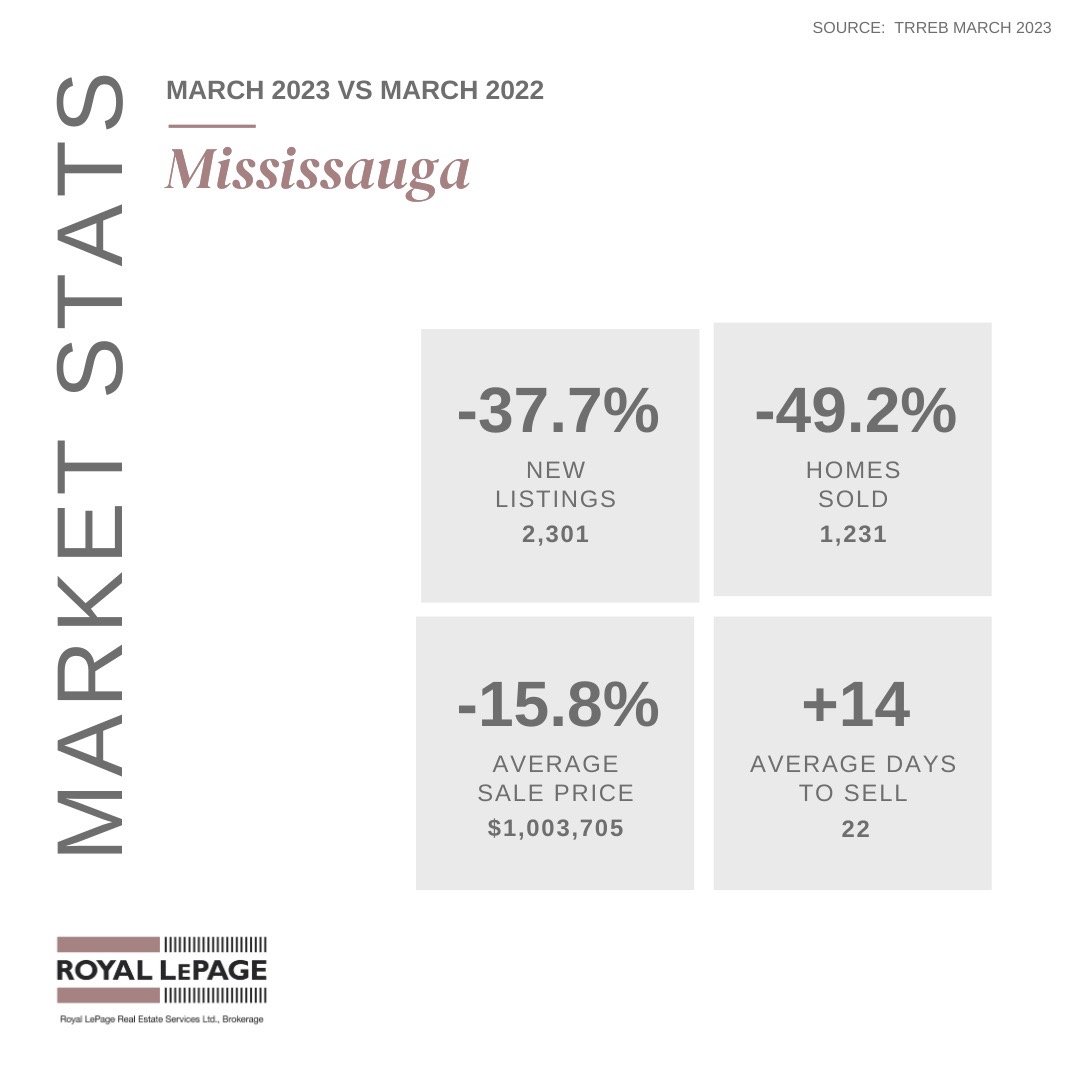

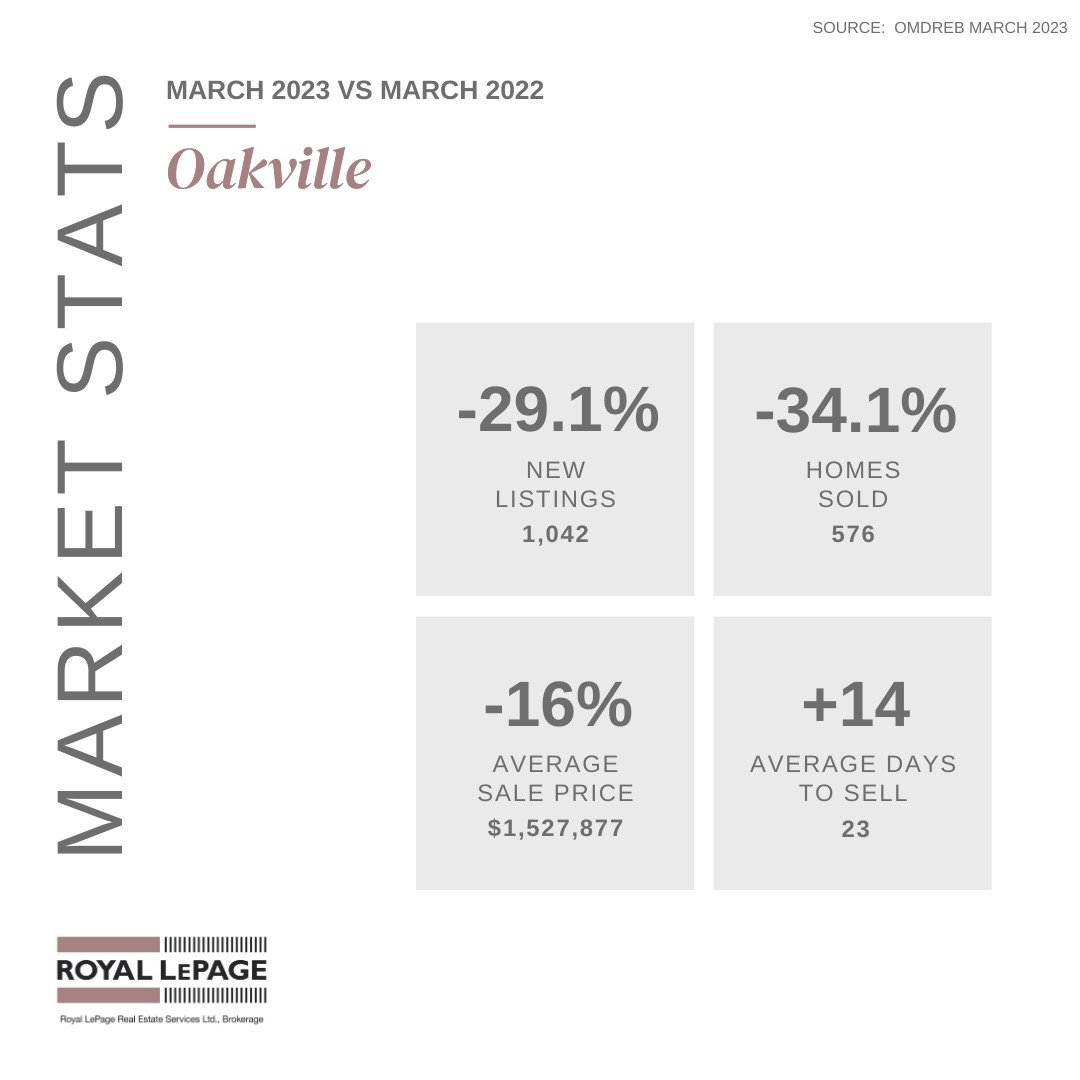

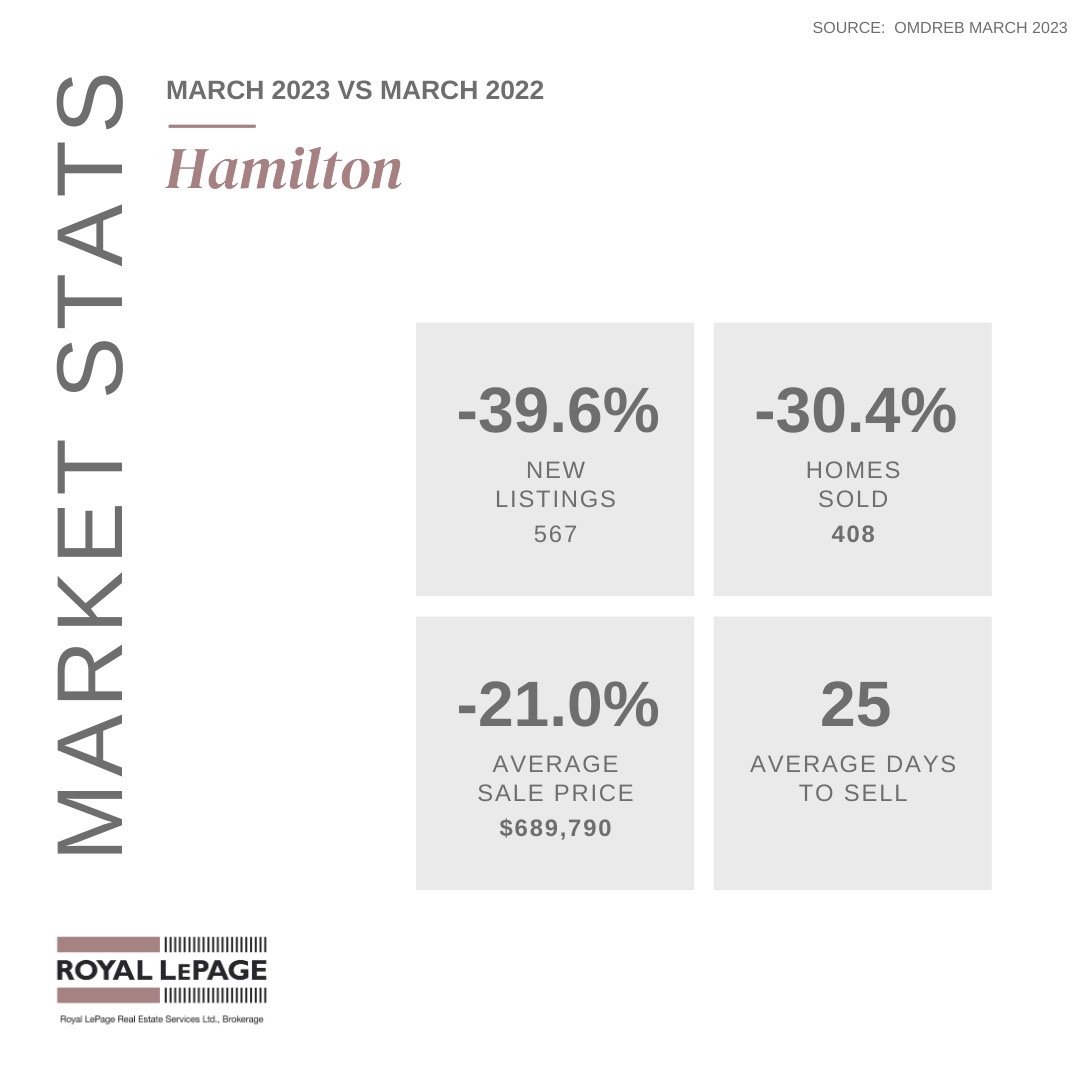

MARKET STATS BY CITY/TOWNS

If you would like to find out what these statistics mean to you, or if you are curious to know how much your property is worth today or how much you can afford to buy, please reach out.

If you found this article helpful please hit "Like" and "Share".

#Maymarketreport #realestatemarketreport #royallepage #torontoliving #torontomarket #thejunction #highpark #bloorwestvillage #swansea #homesellers #homebuyers #realestatebroker #lubabeleybroker #sellingrealestate #sellingtorontohomes #serviceyoucantrust #workingforyou #lubabeleyrealestateservices #royallepagebroker